Data is no stranger to financial institutions. Neither is analytics or decision-making. But few businesses manage to combine these three elements into one efficient system.

Perhaps your company is getting the hang of breaking through data silos. But what about turning those analytical insights into actual business outcomes? If your face just got a bit more somber, fret not! You aren’t alone in this struggle. By their own reckoning, only 7 percent of surveyed banks had achieved full integration of key analytics use cases.

There are several reasons for this low number:

- Most leaders stall when scaling advanced analytics pilots to full-scale initiatives due to a lack of engineering expertise or infrastructure challenges.

- Cultural resistance and lack of change management processes create roadblocks.

Data by New Vantage Partners shows that only 31% of companies have a “data-driven organization,” and only 28% have a “data culture.”

So where does artificial intelligence (AI) fit in this conundrum?

How AI-driven decision analytics can streamline access to data

AI in finance is a hot topic. With streamlined access to data, financial decision support with AI promises to considerably enhance the decision-making process.

Popular use cases of AI include advanced anti-fraud solutions, innovative credit scoring, predictive trading and robo-investing, personal finance coaching, and conversational AI-based customer support.

What all of these use cases have in common is this: their goal is to infuse AI into data processing in one way or another. Humans used to predict all trades. Now algorithms do it quite successfully.

One might say that AI is replacing people in operations that require fast and accurate data analysis. But that’s not fully true. AI prompts people to get out of the way… and shift the focus from pure analysis to weighted decision-making. Data holds the insights that can enable better decisions; processing is the way to extract those insights and take actions. Humans and AI are both processors, with very different abilities.

Artificial intelligence (or more precisely, the suite of technologies underpinning it) has several inherent capabilities, making it a strong contender for decision optimization:

- Accurate pattern recognition

- Ability to create good rules

- Blazing-fast data processing speed

- Ability to anticipate future events

- A way to communicate with others (people or systems)

The wrinkle is that AI can’t always anticipate the full spectrum of weird and wonderful things humans do. As history (and behavioral economics) teaches us, a strategy based purely on mathematical rationality will either fail or underperform.

That’s why we can’t fully rely on AI in financial decision-making. We still need a human to make the final decision.

So what is decision intelligence?

Decision intelligence is the discipline of turning information into better actions at any scale.

A decision intelligence framework leverages AI/ML superpowers to help you make real business decisions.

AI helps you collect the information you need to enable intelligent financial decision-making. It keeps you from settling for a suboptimal choice due to lack of time, facts, or the ability to quickly access data. We can’t know everything, but AI has a much larger capacity than humans to rummage through every bit of data at its disposal.

Here’s a simple analogy from finance to illustrate how artificial intelligence and financial decision-making works:

- AI research can help you build a mobile banking app.

- Applied AI is using that mobile app.

- Decision intelligence is using a mobile banking app effectively to meet your goals and switching to another app when you need to do something else.

In essence, decision intelligence is all about finding the right means and establishing the right process for a streamlined flow of insights.

Now let’s take a closer look at how this happens from the technical standpoint:

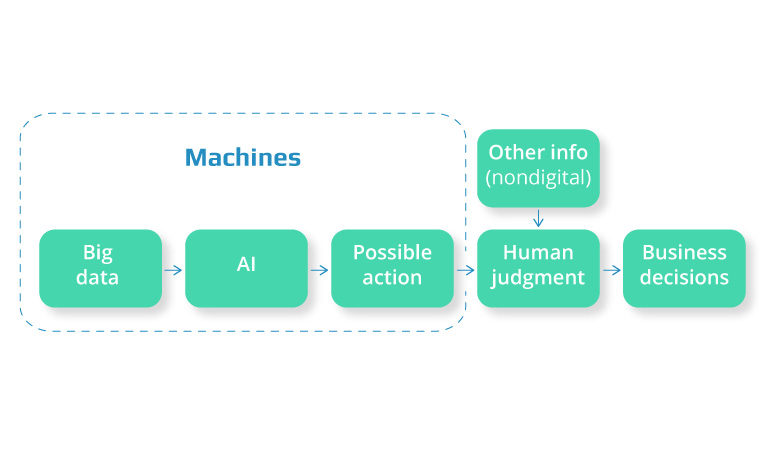

Source: HBR — What AI-Driven Decision Making Looks Like

That’s what an ideal setup should look like.

First, we have a consolidated data lake that securely stores and manages all incoming information from various sources.

Next comes the artificial intelligence in the form of various tech solutions you can plug in to explore your data from different standpoints:

- Financial predictive analytics to anticipate market changes, sales volumes, customer lifetime value, etc.

- Next Best Action engines to suggest the optimal upsell for a customer segment, a personalized portfolio allocation scheme, or the optimal email marketing sequence for a targeted demographic

- Scoring algorithms to prioritize the most profitable leads and develop custom credit scoring models

The role of decision intelligence is to model different outcomes and scenarios based on the available data.

That’s where human judgment kicks in. Artificial intelligence development can work out the perfect outcomes from structured data. But the decisions it suggests may not always align with your wider company vision and strategy — non-digital data and communications.

For example, an AI algorithm may determine that a particular client can maximize their returns if they purchase more stocks and drop some of their bonds. But from personal conversations, you may know that the client prefers a safer investment strategy.

Or the decision algorithm may suggest that now is the best time to invest in an aggressive push notification campaign, but you’d prefer not to undermine your brand image by annoying the heck out of your user base.

The point is that AI is great at suggesting various means to an end so that you can cherry-pick the best options using your judgment.

AI-driven decision intelligence in action: financial use cases

Enough with the theory. Let’s move on to the practical part describing big data analytics use cases financial services use. Yes, adopting advanced analytics is a struggle for most financial companies. But those who persistently push ahead are seeing great ROI, especially in the following niches.

Asset and investment management

This field is particularly ripe for the adoption of decision intelligence! Here are the top use cases worth looking into:

- Analysis of alternative data for investment decisions — weather forecasts, online company sentiment, media coverage, etc. — to improve hedging strategies

- Intelligent client outreach based on recent behavior patterns both online and in-person

- Real-time access to automated insights on individual customers’ portfolios

Morgan Stanley WealthDesk is a great example of decision intelligence in action. The WealthDesk platform allows Morgan Stanley advisors to run advanced scenario analysis for their clients in real time and propose an array of viable investment strategies.

WealthDesk also has a predictive Next Best Action (NBA) tool, powered by machine learning, that can make highly accurate predictions for Morgan Stanley customers based on recent life events. For instance, if a customer recently had a child, the system may suggest the optimal time to set up a college fund and offer a series of other financial management tips.

Retail banking

Retail banks also have a lot to gain from advanced analytics, especially in light of rising competition from digital banks.

Here are several main value opportunities:

- Improved pricing strategies. One US bank used machine learning to analyze discounts private bankers offered their customers. What they found was that their bankers doled out unnecessary discounts too often. After correcting the strategy, the bank’s revenue within several months.

- Data-driven product marketing.After deploying a group-wide analytical ecosystem, Lloyds Banking Group attributed 24% of new leads directly to the new analytics solution as it enabled the bank to market their products with higher precision at the right price point.

- Advanced segmentation and personalization. An Asian bank fed several datasets to its proprietary decision engine: customer demographic data, credit card statements and transactions, POS data, online and mobile payments, credit bureau data. After churning through all those insights, the system identified over 15,000 micro customer segments. As a next step, the bank developed a next-product-to-buy model that suggested the right products to these segments. As a result, the likelihood of a sale increased threefold.

Beyond making decisions, AI engines can do all sorts of lead scoring tasks and optimize backend operations for lending as a service platform such as loan and credit card approvals.

Payments

For banks and payment services providers, decision analytics can be a game changer for customer security. Retire those outdated rule-based systems and embrace adaptive measures, continuously adjusting security levels based on customer behavior.

Such systems can not only stave off fraud but help you build better relationships with your customers. Did you know that 73% of shoppers in the $800,000 to $999,999 annual income bracket have reported having their card declined at least once when shopping online last year? That’s compared to a 30% average across all customer segments. Clearly, their banks aren’t winning any points for that.

Decision intelligence can help you balance the need for top financial security with a great customer experience. Take Mastercard’s Decision Intelligence solution as an example. It collects a customer’s debit and credit card data in real time and then uses machine learning algorithms to analyze various data points associated with a transaction and determine if it’s legitimate or fraudulent. Their algorithm has been perfected on hundreds of thousands of datasets and has an incredibly low rate of false positives.

Similarly, intelligent decision models can be deployed to perform automated due diligence for large transfers(including cross-border ones) to speed up clearance. The “three-day good funds model” is no longer good enough for most customers.

Lastly, infusing your payments with better analytics is great for sales. By analyzing different spending patterns, your system can work out the best product recommendations, personalized cashback and loyalty offers, and other perks — or even suggest brand-new services like an instant credit line for customers with good standing and low account balances when entering their favorite store.

To conclude

Two heads are better than one — especially if the second is an AI copilot. Decision intelligence solutions are just coming to the fore, but early tests show they have strong viability and proven ROI.

Think about it: what if you could rapidly access product recommendations for a customer sitting in front of you? What if someone could suggest how to prioritize various products? Or gently nudge you to invest more in marketing to meet those yearly sales goals?

Investment decision analytics can help you power up your decision-making and supply you with the right insights at the right time.

Contact Intellias to talk about financial analytics and all things decision intelligence!