Digital account opening remains a sore spot for many banks. Even though digital onboarding continues to be their strategic objective — with 55% of financial institutions naming digital account opening services as their top feature priority — few experience tangible results.

The Battle to Onboard 2022 survey by Signicat reveals that 68% of financial services consumers abandoned an online account application in 2022 — up from 63% in 2020 and 35% in 2018. That’s a problematic trend, as lost digital sign-ups translate to lost opportunities.

- 24% of UK consumers use a digital-only provider for their banking needs. 5.3 million more (10%) plan to get a digital-only bank account by the end of 2023.

- The percentage of digital-only bank account holders in the US is expected to grow from 11.4% in 2021 to 19.9% in 2025.

- The operating cost base of a digital-only bank platform is 60% to 70% lower than a traditional bank.

So why are most banks still behind in terms of an online account opening system despite investing in digital transformation?

Most legacy banks invested heavily in the technology that underpins new onboarding processes, but unlike the upstarts, have failed to rethink the processes themselves. That is why they are falling behind, and that is why customers are still failing to complete applications.

In other words, to compete with digital banks, legacy institutions need to think beyond mere investments in technology and payment platform architecture. They need to focus on customer research.

That’s exactly what solid digital account opening solutions are designed to accomplish.

What is digital account opening?

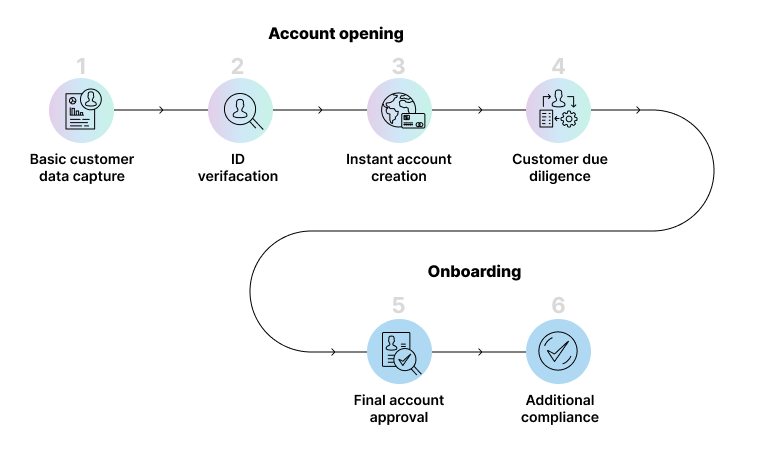

Digital account opening (DAO) is a three-pronged process for opening a bank account remotely. It fulfills three core functions:

- Customer acquisition. With DAO, a bank remains open for business 24/7. DAO provides customers with a straightforward interactive experience, enabling them to select the right product and complete an application.

- Origination. Digital bank account opening allows you to capture essential KYC (Know Your Customer) data and use digital identities and biometrics to automatically approve account creation.

- Onboarding. Banks can make a memorable first impression by wowing customers with a smooth user experience.

It’s high time to embrace online account opening software for banks. Around 75% of retail banking customers express willingness to open a new account digitally, while less than 30% of banks globally have launched digital acquisition journeys on their websites or apps.

Recent statistics highlight the resistance of traditional banks to launch digital account opening software. While 11.7 million new accounts were opened online in digital-only banks in 2021, only 4.3 million accounts were opened digitally in traditional banks. What might be the reason for such a gap?

Why is it so hard to get the digital account opening process right?

From our experience working with an established global bank, we can say that several factors make it hard to get the bank digital account opening process right:

- Legacy core banking infrastructure cannot accommodate digital account creation. This can be solved by building a separate FinTech layer and connecting it to the core product via APIs.

- Overly rigid compliance processes. Do you need to run extensive background checks that take days when opening current/checking or savings accounts? Not really. Are you still doing that? Yes. And that’s why digital-only banks are way ahead of legacy institutions.

- Lack of integrations for KYC/origination. Similarly, these features can be plugged in via a microservices architecture and open APIs.

- Lack of UX expertise. Most banking products are clunky and contain unnecessary steps. An experienced UX team can help you figure out a better customer journey based on your goals and compliance requirements.

How to design an effective digital account opening process

Here are the exact steps you can take to deliver a superior digital account opening experience for your customers.

Account opening

Step 1: Capture basic customer data

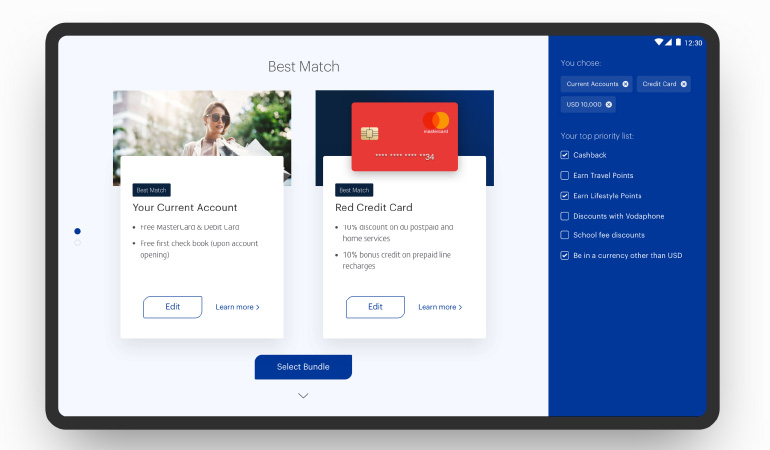

Modern customers expect highly personalized Amazon-style digital experiences. Offer a warm greeting with a survey-based onboarding sequence. Collect some basic personal information and line up several product offers.

What types of customer data should you capture?

- Primary goal: save, borrow, or grow income

- Main priorities: high interest, low banking fees, high rewards/cashback, etc.

- Monthly income: suggest several ranges

- Past relationship with your bank: yes/no

A quiz-style onboarding experience eliminates the paradox of choice and reduces the feeling of being overwhelmed after swiping through five very similar credit card offers.

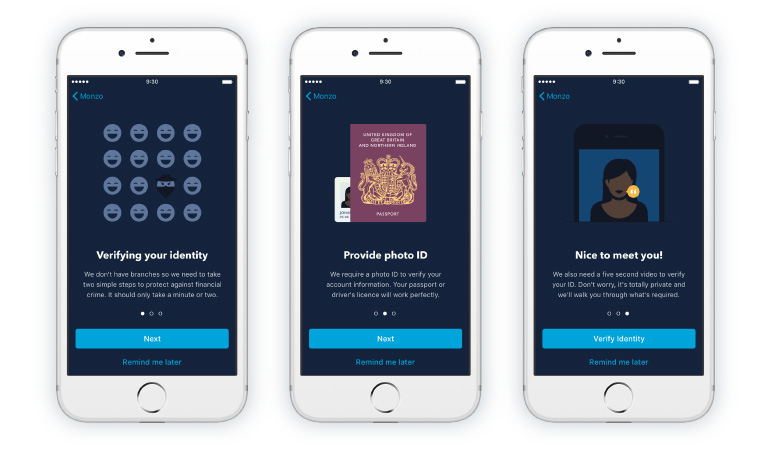

Step 2: Verify ID

Once the customer makes a choice, offer them an easy way to apply and submit all required documents. Leverage native smartphone functionality (camera, location-based services, biometrics, etc.) to capture the minimal KYC information:

- ID credentials — selfie + photo (or video) of a passport, driver’s license, or other photo ID

- Proof of address — uploaded directly or synced automatically from a utility services provider or telecom company

A smartphone’s location features can be used as extra proof of location.

[Online account opening software should feature ID verification through ID credentials or other KYC procedures.]

Source: Monzo

Alternatively, there are several other ways to streamline KYC procedures, especially when customers apply for more sensitive financial products like credit cards or loans.

- Allow sign-ups using digital IDs granted by other financial institutions or third-party providers. Mobile ID credentials are another option.

- Use alternative credit data obtained from telecom or utility providers or self-reported by users.

- Provide a self-report form so users can include any additional documents they deem necessary.

Step 3: Instantly create an account

Once the customer provides the minimum required information, you can instantly issue mobile banking login credentials. But is it safe to do so?

Usually, traditional banks implement KYC due diligence. While this is a reliable security measure, it has become a significant bottleneck for new bank customers. Banks report that around 40% of the time spent onboarding a new corporate customer is actually dedicated to KYC due diligence and account opening.

That’s why most digital banks have turned to Simplified Due Diligence and, as a result, have grown their user bases in record time. Instead of instantly intimidating prospects with a mountain of paperwork, they settle for Simplified Due Diligence, or SDD — a KYC policy that assumes low risks of money laundering and other regulatory breaches and is mainly applied to low-value accounts.

Only after the user has gotten a good taste of their new account and has tried some basic features are they asked for additional regulatory-driven information.

Step 4: Customer due diligence

While your new customer enjoys a quick account tour, you can conduct further background checks… in the background.

By leveraging AI and machine learning , you can run a comprehensive anti-money laundering (AML) check before unlocking access to more sensitive banking features. That’s the not-so-secret sauce to blazing fast and secure digital account opening. You can learn more about up-to-date machine learning use cases in our New Age in Digital Banking whitepaper.

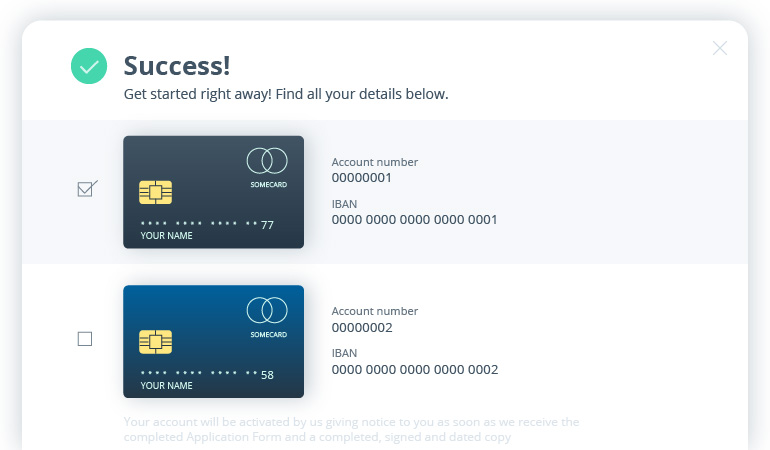

Step 5: Final account approval

Once you’ve verified the customer’s information and assigned a low risk score, it’s time to grant full account access.

Extend a welcome kit providing further onboarding prompts regarding account top-up options and the card ordering process. Prompt users to set up all key account security features, such as:

- Two-factor authentication or biometric login

- Card PIN and transaction limits

- Privacy settings

Step 6: Additional compliance

Create an ongoing KYC process that will be triggered by certain events:

- Large deposits

- Unusual cross-border transfers

- Frequent cryptocurrency trading, etc.

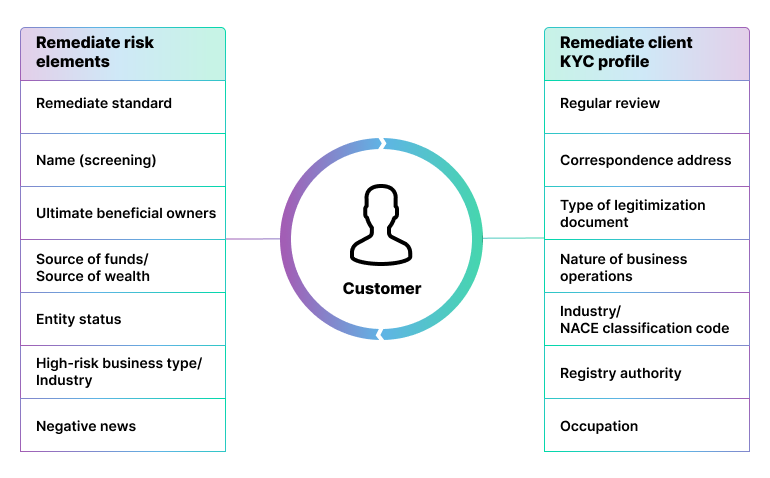

You can rely on big data analytics to determine when additional checks are required and develop custom KYC policies for every customer based on:

- Their location, considering local compliance requirements

- Occupation/type(s) of income

- Common transaction types and spending patterns

- Past records with your bank or partner services

Doing so can help you collect the information required for compliance without alienating the customer at the early stages of product use. Also, adopting such a risk-based, data-driven approach can help you avoid the costly KYC remediation cycle.

Intellias’ experience with banking sector innovations

With more than 20 years of experience building custom FinTech software solutions, Intellias knows the pain points and growth opportunities for financial organizations of different scales. We focus on introducing new technologies such as AI and machine learning, eKYC, big data analytics, and cloud integration to bring innovation for better, data-driven customer service.

Take the example of our recent collaboration with a well-established commercial bank. This organization sought digital transformation to achieve a greater competitive edge and create a resilient banking architecture in times of uncertainty.

As the client set out on the path to build an in-house IT team, Intellias engaged in long-term cooperation with business and technology consulting. The results of this partnership were establishing all the bank’s DevOps activities and building the IT layer, as well as introducing a new business model and a range of new services.

With our help, the bank launched a cutting-edge payment processing system that works around the clock, a corporate payment engine for automated cross-border operations, and a convenient salary platform for monitoring transactions.

Go digital with onboarding, or become obsolete

Yes, it sounds harsh. However, customers switching financial providers cost banks $80 billion in annual revenue in 2022. If there is a provider with a more convenient and customer-friendly offer, your customers will switch to it. Online account opening software can become the first step toward larger core business transformations.

As Millennials and Gen Z consumers are becoming the dominant customer segment with the most wealth, there’s not much wiggle room left. This cohort will not wait a week or longer to open an account. Or settle for lackluster, extensive KYC procedures. In a few taps, they’ll switch to a competitor offering a faster, more streamlined account opening experience. And you don’t want that to happen, do you?

Let’s improve your user experience together! The Intellias design team can help you figure out the optimal user flows while our software engineers advise on the optimal KYC infrastructure. Contact us!