The insurance market is a top influencer within the global economy. Businesses, individuals, healthcare organizations, and government institutions all need a variety of insurance. Despite the substantial market size, the current insurance system is bulky and requires better rapport between parties and stakeholders. Building insurance smart contracts instead of drafting inconvenient paper agreements can change this situation.

Join us for a discussion about the stages of implementation and benefits of using blockchain development services and smart contracts in insurance.

What are smart contracts, and does the business world really need them?

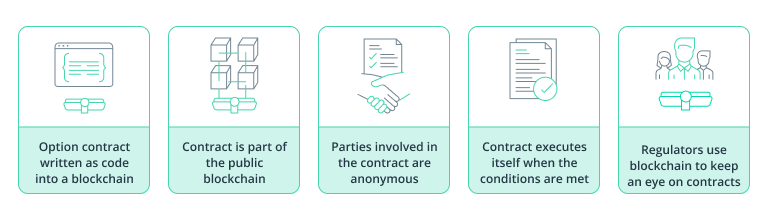

Smart contracts, powered by blockchain technology, have significantly influenced the business landscape. These self-executing computer programs automatically enforce predefined agreement terms when specific conditions are met.

According to SkyQuest report, the global smart contract market value is projected to experience an 82% compound annual growth rate (CAGR) by 2030, from USD 0.69 billion in 2022 to USD 83.07 billion.

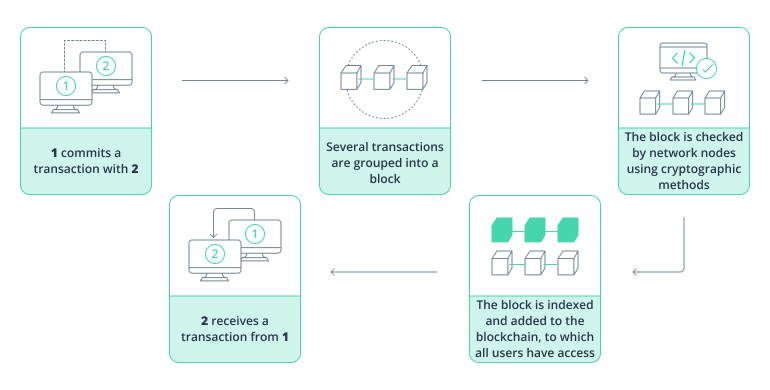

To grasp what smart contracts are, we must first understand the notion of blockchain. People are used to thinking about Bitcoin when they hear blockchain. Actually, there are other ways to use the technology.

Thanks to blockchain technology, organizations can store data distributedly. As a result, transactions can be executed through the code automatically, excluding any third-party intruding into the agreement.

Blockchain enhances security and reliability by ensuring the immutability of transactions through automatic chain linking. Today, Ethereum is the preferred platform for creating and executing smart contracts.

How smart contracts work in blockchain

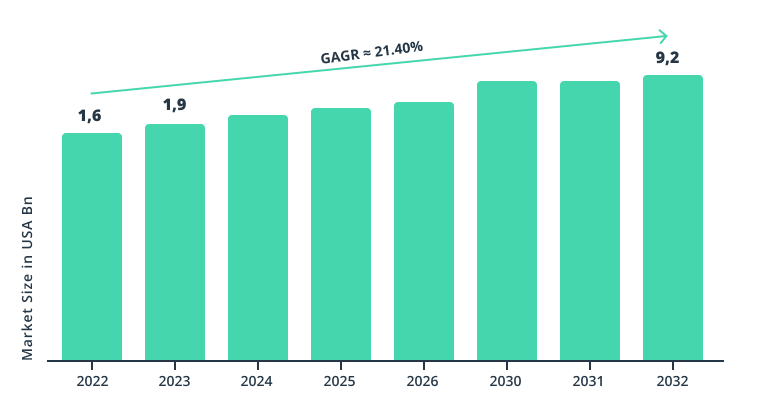

According to data from the recent Smart Contracts Market Research Report from Market Research Future, the global smart contracts market will reach approximately $9.2 billion by the end of 2032, with a 21.40% CAGR during the forecasted period from 2023 to 2032.

The global smart contracts market in USD billions

Companies in the banking, government, automotive, healthcare, real estate, and insurance sectors are interested in making this technology work for them. Let’s explore the advantages of smart contracts in insurance and why this domain needs this technological advancement more than others.

Smart contracts for insurance are a turn for the better

First and foremost, blockchain smart contracts in insurance can remedy the industry’s challenges. Overloaded with uncertainties and hesitations, what is lacking in the insurance industry is people’s trust. According to a Harris Poll survey in the United States, there is a notable lack of trust in insurance companies. The survey found that satisfaction levels with insurance providers are relatively low: 42% among Gen Z (those under 26), 43% among Millennials (aged 27-42), and 46% among Gen X (aged 43-58) participants.

Even though customers tend to think that the ultimate goal of an insurer is to pay as little as possible, insurance companies also have their own pains. Policyholders too often cheat and make false claims to receive payouts. So, the lack of trust is really a mutual issue. Smart contracts insurance can re-establish trust and make intermediaries obsolete.

Software algorithms within code can eliminate administrative barriers, predict insurance payout scenarios, and automatically execute the agreement terms, leaving no space for manipulation on either side.

Top benefits of blockchain smart contracts for insurance companies

Technological disruption is prompting every insurance company to take action and find out how to get the most out of smart contracts. The benefits of using this technology in the insurance industry are substantial.

Less fraud through transparency

This particular advantage of smart contracts in insurance is possible because of the blockchain’s decentralization and openness. As there is no owner, anyone can see any transaction logged in a blockchain database. All parties will see any change so that no inconsistencies will be missed.

Task automation

Thanks to the blockchain, all smart contract-related procedures are automated and can be securely rendered. The key benefit here is the absence of human input. This reduces the risk of manipulation. Moreover, blockchain allows companies to perform their processes more transparently and conveniently.

Save time on verifying claims

Blockchain smart contracts in insurance completely substitute for verifying claims manually. There are no documents needed, just fixed rules to settle claims. Faster processes, better efficiency, and decreased costs — nothing but benefits for insurers.

Protect policy documents

Insurers can store documents on numerous ledgers, so it is virtually impossible to lose them. Thanks to their technical characteristics, it is possible to prevent data loss and damage.

Risk assessment

Blockchain technology allows insurance companies to integrate advanced risk assessment models into their transactions. This capability relies on a blockchain-based identification system, where IDs undergo instant verification and receive real-time updates with new data. This streamlines the typically time-consuming identity verification process. Smart agreements access comprehensive individual information and evaluate risks, simplifying data collection and verification efforts.

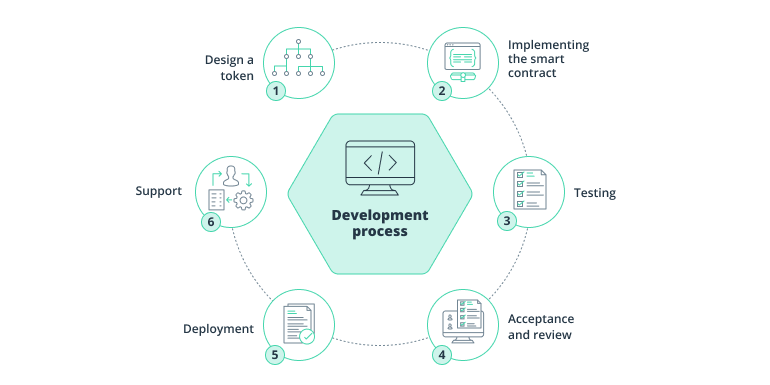

Development phases of a smart contract explained for insurance companies

Building a smart contract is somewhat intimidating for the majority of insurance organizations. And for good reason. However, if insurance providers are planning to create advanced customer-centric products, it’s best they know what to expect from the development process. Without exploring complex technical matters, the following development stages will give you an overview of the process.

Designing a token

The Ethereum network allows users to develop their own tokens to perform specific functions. The trick here is to decide what functions to execute and what business logic to include.

Implementing the smart contract

Ethereum provides a virtual environment called the Ethereum Virtual Machine. The Solidity programming language is used to build Ethereum smart contracts. It is an object contract-oriented, high-level language created particularly for implementing smart contracts.

Testing

Deploying smart contracts on a blockchain network is a crucial step, but it can introduce testing complexities. Fortunately, autotests offer a robust solution. These automated tests ensure that a contract performs according to its intended design by simulating real-world scenarios.

Acceptance and review

Even without verification standards for smart contracts, there are particular environments where developers can verify their code and logic. A proper acceptance and review process has to cover cost-effectiveness, including many reviewers and ensuring result visibility.

Deployment

In this phase, we take the critical step of deploying the contract to the Ethereum blockchain, ensuring universal accessibility. Engineers often employ specialized tools for efficient deployment. The usual procedure involves submitting the code to the blockchain, where it awaits processing through the mining process. Once successfully mined, the agreement is officially considered deployed.

Support

An insurance provider that operates blockchain technology should have their own or outsourced capacities to maintain the infrastructure of their smart contracts.

Smart contract lifecycle phases

Irrespective of the industry, there are four main phases of a smart contract’s lifecycle:

-

- Creation

The parties agree on the agreement’s contents and objectives. Next, it is coded via the development phases as described above.

-

- Freezing

After a smart contract appears on the blockchain, it becomes public and accessible via the public ledger. At this stage, the two contractors have to meet all the agreement requirements, pay a fee, or send an asset to further execute the blockchain. Moreover, transfers to the wallet address defined in the document are frozen until all conditions are met.

-

- Execution

When the agreement executes, new transactions are once again stored in the distributed ledger. Transactions are validated by the consensus protocol.

-

- Finalization

A smart contract is considered finalized after assets have been unfrozen and all transactions have been confirmed.

Example of a smart contract solution for vehicle insurance

According to Capgemini World Property and Casualty Insurance Report 2023, the auto insurance industry will rise from $0.65 trillion in 2023 to $1.38 trillion in 2030. The introduction of new technologies that allow process automation and reduced overhead in claims handling, like smart contracts, is one of the reasons for such progress.

Intellias has helped a blockchain startup develop a smart contract solution for one of the leading European insurance companies. The primary goal of this project was to create a web app to enable online vehicle insurance policy purchases. As a result, the insurance company got a suite of highly scalable smart contract products that included a language for defining agreement specifications and an operating system for managing and storing insurance smart contracts.

The delivered prototype can insure vehicles electronically, manage auto insurance history, and automatically submit auto insurance claims. This is just one example to prove that insurance industry players are ready to learn how to turn smart contracts into their main competitive advantage.

Constraints of blockchain smart contracts in insurance

Although blockchain technology itself is not new, it’s broader application in various industries, including insurance, has taken time to develop and mature. The same goes for implementing smart contracts as a reliable universal business solution. Let’s explore the concerns limiting the adoption of this technology.

Limited contract scope

The most significant constraint that can limit the benefits of using smart contracts in insurance is the necessity to cover every eventuality in a code. Processes that can be done relatively easily on paper can be difficult to translate into code. Especially because most companies start building them with the simplest models, using the pattern: If X occurs, then Y will happen.

Technological complexity

Building a sophisticated blockchain smart contract in insurance requires a particular level of programming knowledge. Only specialists well-versed in Ethereum can create a well-run product. Naturally, it’s quite a challenging task since the technology is quite complicated and involves an in-depth understanding of software development.

Possible bugs in code

Smart contracts might be tricky. Since they’re executed sequentially, if at least one vital piece is missing, the document won’t run. Even though eliminating human input is among the top advantages of this technology, it still requires human engagement at the development stage. And don’t forget that to err is human.

Uncertainty of legal regulations

It’s no secret that the insurance industry is among the most regulated. But despite the keen interest in blockchain technology shown by government institutions, smart contracts are still, by and large, unregulated. How to use them properly and in a legally sound way remains unclear.

Smart contracts aren’t a mature technology, but it’s clear that the broader use of the blockchain is already changing the custom insurance software. Insurers can automate their policies and services, decrease administrative and claims processing costs, increase transparency, and prevent fraud. Intellias supports innovative endeavors and is ready to help implement blockchain technology and smart contracts in particular.

Feel free to contact us if your business is considering implementing smart contracts or wants to explore the opportunities they bring.