Insurance companies face multiple challenges: they must predict risks accurately to minimize financial losses, process claims quickly to avoid frustrated customers, and detect fraud before it impacts the bottom line. Without the right data and tools, these challenges can seem insurmountable.

This is where GIS data for insurance companies comes in. By leveraging GIS services, insurers can:

- Provide highly accurate, data-driven risk assessments

- Optimize underwriting and claims processing

- Crosscheck potentially fraudulent claims with real-time environmental data

- Provide detailed customer insights and personalized services

The result is a more efficient and profitable insurance business — and happier, more loyal customers.

In this article, we’ll explain everything you need to know about GIS in insurance. Read on to explore how GIS data is being used by insurers, key challenges, and how to implement GIS in your business.

Why GIS is a game-changer for the insurance industry?

Insurance is all about managing risk, but traditional methods no longer cut it. Underwriters need precise, location-specific data to price policies effectively, and claims teams need it to respond as quickly as possible.

This is why GIS is such a game-changer. With access to real-time GIS (Geographic Information System) data, insurers can understand the world around them and how different environmental factors impact risk. With the threat of climate change and extreme weather growing, geospatial data for insurance has never been more important.

The adoption of GIS insurance technology is being shaped by technologies such as real-time data analytics and artificial intelligence. Together, they are transforming underwriting, policy pricing, fraud detection, and regulatory compliance through detailed insights and automated processes.

How insurance companies are using GIS data?

We’ve already touched on prominent use cases of GIS in the insurance industry. In this section, we’ll dive a bit deeper, looking at some real-world applications and benefits of GIS for insurance companies.

Risk assessment and underwriting

Environmental threats are an increasingly pressing issue for insurers. With the risk of wildfires, floods, and extreme weather growing, insurers need reliable data to help them predict climate-related risk.

With GIS data, insurance companies can assess these environmental hazards with unprecedented precision. At the same time, high-resolution property mapping provides insurers with reliable and accurate valuations based on environmental risk factors. This is transforming the underwriting process.

Source: Ecopia

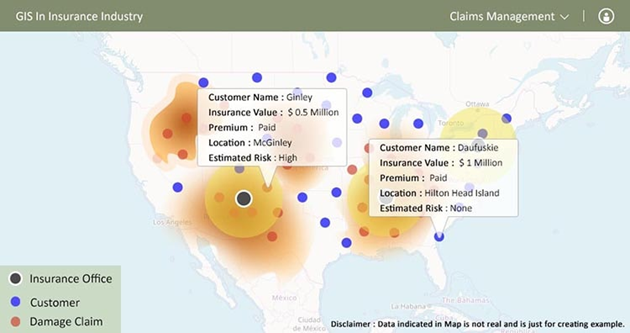

Claims management and fraud detection

Customers expect claims to be processed fast. Delays damage trust and lead to wasted time and rising costs. Insurance geospatial analytics speed the claims process up by mapping disaster zones in real time and verifying claims rapidly.

Geospatial analysis in insurance can also flag anomalies, potentially saving insurers huge sums of money lost to fraudulent claims. For example, if a customer makes a claim on a “flooded” house that’s miles from water and has no history of flooding, GIS can scan the location to verify whether the claim is false or not.

Source: IGISMAP

Disaster response and mitigation

When a hurricane or earthquake hits, insurers and response teams need to move fast. Without accurate real-time data, it’s virtually impossible to launch an effective response strategy or understand how different areas may be affected.

GIS data applications in the insurance industry help predict and analyze the impact of natural or man-made disasters. Insurers can map high-risk areas and identify customers who may be affected. Using these insights, insurers can process claims more effectively, optimize communications, and understand future risks.

Source: Ecopia

Customer insights and personalization

Today, 71% of customers expect businesses to provide personalized interactions and services. Businesses that excel at personalization are 41% more likely to exceed revenue goals, and 71% more likely to report improved customer loyalty.

Using geospatial analytics insurance tools, insurers can understand customer demographics and behaviors better. This allows them to provide the tailored offerings and communications that customers expect.

Key types of GIS data for insurers

Data is the fuel that powers GIS in insurance. But what types of data are we talking about? Here are three key data types that insurers can use to enhance their operations:

- Geospatial risk data. Used to understand the likelihood of certain risks — such as floods, wildfires, or earthquakes — based on the location of a property or land. This improves the speed and accuracy of risk assessments, underwriting decisions, and claims management.

- Property and infrastructure mapping. Used to analyze property locations and generate accurate valuations.

- Historical and real-time environmental data. Used to improve risk forecasting and provide live updates on extreme weather or natural disasters.

- Demographic and socioeconomic data. Used to segment clients, price policies, and offer tailored marketing communications.

Let’s look at a real-world example. Our client provides hardware and software for sophisticated natural disaster information systems. We helped them build a bespoke disaster mitigation tool that uses real-time environmental data to monitor and predict extreme weather patterns and natural disasters.

Read the full story here: Weather Prediction and Disaster Management Using GIS.

Challenges of using GIS in insurance

GIS in insurance brings tangible benefits, but it’s not risk-free. Working with GIS data is a highly technical undertaking, and the smallest issues can have a big impact on the quality and reliability of outputs. Below, we’ll take a brief look at some common GIS challenges — and how you can overcome them.

|

Challenge |

Solution |

Business benefit |

|---|---|---|

|

Inaccurate data and integration issues |

Partner with GIS experts for high-quality data and hassle-free integrations. |

More reliable insights. Less rework. |

|

Privacy and compliance issues |

Implement robust security protocols and compliance tools. |

Maintain trust and reputation. Avoid fines for non-compliance. |

|

High costs |

Use scalable cloud-based GIS platforms that are tailored to your needs. |

Higher ROI. Faster time to value. |

How to implement GIS in your insurance business

Success with GIS data isn’t guaranteed. To reap the rewards, you need to plan your implementation effectively. Here are some key steps to follow:

- Assess your needs. Before you go ahead and implement GIS, you need to answer some important questions. What are your biggest challenges? What areas do you want GIS to optimize? How will you define and measure success?

- Choose the right GIS platform. Choose a platform that integrates with your existing insurance software and systems. Off-the-shelf solutions may be cheaper, but custom ones will be tailored to your specific needs.

- Leverage AI and ML. These transformative technologies can magnify the power of GIS data for the insurance industry, providing deeper insights and automated processes.

- Train your team. Before going live, make sure your team has the training and resources they need to use your GIS platform effectively. To ensure adoption, communicate the “why” as well as the “how.”

- Implement, monitor, and improve. Now, it’s time to start using your GIS platform. We recommend starting small with narrow use cases before rolling it out company-wide. Once live, you’ll need to continuously monitor and refine your GIS strategies based on data insights.

Why Partner with Intellias as a GIS software development company?

Maximizing the value of GIS data can be a challenge — especially if you don’t have expertise in-house. This is why it pays to work with a GIS software development experts at Intellias.

We help businesses capture environmental and geographic data — and then turn it into insights that transform insurance operations. Our developers work with leading GIS service providers to build custom solutions designed to meet clients’ individual needs. With Intellias, you get:

- Help at every stage of your GIS journey

- Scalable solutions that grow with your business

- Hassle-free integration with your existing software and processes

- Faster deployment and time to value

- Ongoing support from a team of leading GIS experts

Conclusion

In a data-driven world, GIS is now a must for insurers. By leveraging GIS data, you can produce more reliable risk assessments, speed up claims processing, and detect fraudulent claims before they hurt your bottom line and credibility.

To maximize the GIS opportunity, it pays to work with experts. At Intellias, we offer end-to-end GIS services — from data consultancy to hands-on support in building custom GIS-powered solutions.