In the past few years, big things have happened in the FinTech space.

As an industry veteran, you’ve probably heard all this before:

- The FinTech sector is smoking hot: investments are ripe, competition is fierce, and demand is high.

- Millennials are the driving consumer force, gradually building up their wealth and on track to dominate the financial space by 2029.

- AI, ML, and big data analytics are becoming commodity technologies. They’re no longer nice-to-have but rather are a necessity to compete.

- Open APIs, platformization, and bundling are also trends.

So, will there be any really new financial services industry trends in 2024? Yes and no.

We believe that 2024 trends in FinTech will be defined by the rise of the connected consumer, whose pains, needs, and demands will drive product development and shape the overall vector of the financial industry. The potential of AI will be actively explored to meet these pains and needs.

This year, instead of talking about individual tech trends, let’s go on a bit of a journey through the customer looking glass.

The era of connected customers has arrived

Once upon a time, all a customer expected from a bank was to store their hard-earned cash and provide some way to spend and withdraw it. Then came challenger banks and other FinTechs, who showed that all things finance could be lightning-fast, mobile-friendly, and affordable.

Meanwhile, customers grew accustomed to top-notch omnichannel experiences thanks to Amazon, Uber, and others, condensing once-daunting processes into one click. Gradually, customers have developed a digital ecosystem of products to fulfill their every need. Now, FinTech apps have the opportunity to find their place in the heart of that ecosystem.

As we highlighted in our New Age in Banking whitepaper, Millennial and Gen Z consumers — the key target demographics for 2020–2030 — want to see their banking products as companions and advisors who are helping them reach their financial goals. And Gen X is not far behind Millennials in FinTech adoption.

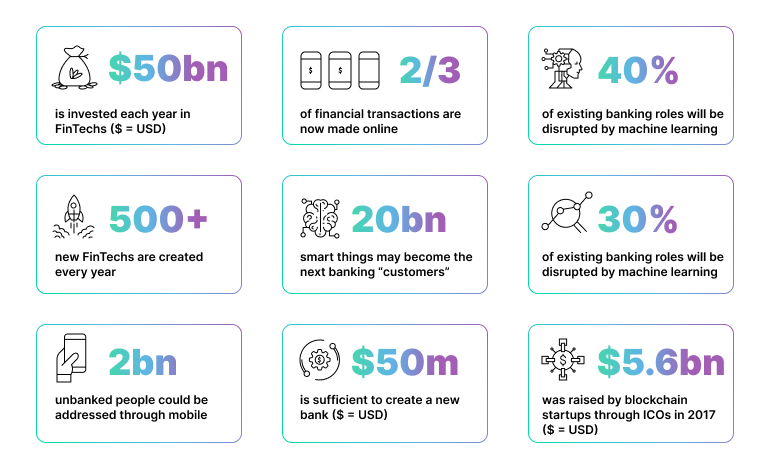

Plus, in the past few years, FinTech awareness has surged globally:

Source: DemandSage

In 2024, the customer experience (CX) is still a battlefield for FinTechs. Most financial companies have made huge progress in catching up with consumer FinTech trends. Collectively, FinTechs have reimagined the once-daunting tasks of opening a bank account, sending money to friends, applying for a loan, and planning for retirement.

Now, mature FinTechs will need to transpose that smooth CX from single-purpose to multi-purpose financial products. We’ve come up with a good formula for that:

Machine Learning (ML) + User Experience (UX) = Top FinTech Customer Experience (CX)

In a nutshell, connected customers want financial products that are:

- Simple and intuitive

- Frictionless

- Engaging and interactive

- Able to solve one pressing money matter (or, better, several at once!)

- Personalized to their needs

- Designed to proactively help them get better at what they want to accomplish

- Built around a consistent, connected customer experience

We have already seen the efforts of both incumbent banks and FinTechs to meet these demands. In 2024, most will likely keep following consumer finance trends to build better, smarter, and more complex products.

Intellias take on financial services industry trends

FinTechs are now competing at the ecosystem level. In 2024, we’ll likely see more marketplace banks, a bunch of new super apps, and loads of cross-industry partnerships — all aimed at meeting the demands of connected consumers. To bundle or not to bundle? That’s the big industry question. Younger FinTechs are getting their slice of the market by going after digital trends in niche use cases: small business digital banking, bill consolidation, startup credit cards, you name it. Bigger unicorns are full-speed ahead, beefing up their core offerings with additional products. Consider Wealthfront’s move into savings accounts. Both approaches have their merits

Collecting and operationalizing customer data will remain imperative. FinTechs should continue to focus on viable machine learning and AI use cases, deploying predictive analytics to gauge a user’s current standing and future financial aspirations, devising the next best action strategies for them, and delighting with AI-driven personal finance management.

And, yes — customer-centric is still a huge buzzword. We believe that the financial system as a whole is evolving to meet customers’ needs.

Download infographics

Download infographics

The “let’s do money better” trend — financial literacy

In 2024, we should address the elephant in the room:

Most of your customers are bad with money.

Heck, they’re the first to admit it.

- Gen Z and Gen Y have the lowest financial literacy rates among US generations.

- Lack of financial literacy cost Americans an estimated total of $388 billion in 2023.

- The typical checking account balance in the United States hovers around $8,000, which may only cover a couple of months without income.

Also, according to a 2023 Bankrate survey:

- Over 70% of Americans feel financially insecure, with only 28% considering themselves completely secure.

- Nearly half of financially insecure Americans (46%) believe they will achieve complete financial security in the future, while 26% feel they will never attain it.

Generation X (ages 43–58) has the lowest financial security among all generations:

- Gen Z (18–26): 25%

- Millennials (27–42): 28%

- Gen X (43–58): 19%

- Baby Boomers (59–77): 32%

According to a CNBC Your Money Financial Confidence Survey, 70% of Americans admit to being stressed about their personal finances these days.

How about offering these people some help?

FinTechs already have the tools to do so:

- Access to a wealth of customer data on spending behavior, recurring payments, categorized spending, upcoming bills, and debt.

- Off-the-shelf customer analytics solutions to provide users with at least an overview of how they’re doing.

- Commoditized access to big data analytics, ML, and AI to build advanced financial coaching solutions.

Investing in customers’ financial literacy is the key to winning customers for the long term.

First, show customers how to avoid overspending on late bills or cancel unwanted subscriptions. Then, teach them how to save more (without sweating too much over it), spend smarter, and invest better.

As people get more savvy with their spending habits, AI is stepping up as a handy helper. One of the widely discussed current trends in FinTech, AI can help consumers identify savings opportunities, especially in managing liabilities. As users become more comfortable with AI managing liabilities like debt, more financial companies will consider integrating AI capabilities into their products. AI can automate or ease including managing checking, savings, and retirement accounts, tax filings, and more

Educating users about AI-driven financial management is vital for fostering satisfied, loyal, higher-net-worth customers who remain with your brand for the long term, resulting in mutual benefits.

Autonomous finance — “Doing money better” on autopilot

Having computer code decide how we should save, spend, or invest our money isn’t a futuristic idea. It’s the AI-powered reality in 2024.

AI-driven personal finance and wealth management are already here, as we highlighted in our article on new-gen personal financial assistant applications.

Consumers who are burned out and stressed out clearly vote in favor of this hands-free approach to managing their money.

Wealthfront, Acorns, Betterment, Credit Karma, and SoFi are on the road towards becoming one-stop shops for automated money management.

How comfortable would you feel using each of the following services?

Source: Quartz – Get ready for self-driving money

We expect to see the growth of AI in:

- Investing. Are you ready to meet Robo Advisor 4.0 that uses self-learning AI to balance your portfolio in real time based on market conditions, your stated goals, and your financial behavior?

- Personal finance and budgeting. Perhaps you’d like a financial assistant that suggests when to pay your bills, which savings account to use, or where to find cash for that dream vacation?

- Lending. Get approved for a loan in seconds, automate improvements to your credit score, and receive personalized credit offers with lower fees — these are just a few things autonomous lending apps promise.

- Fraud detection and prevention. Banking apps can use AI algorithms to monitor transactions in real time for any suspicious activity. Instant notifications or alerts from banking platforms may seem annoying, but they’re just keeping your money safe.

- Wealth management.AI offers broader potential with robo-advice for investments, algorithmic trading, portfolio management, and data analysis.

As AI becomes a commodity technology, great things can happen.

Intellias’ tips for personal finance products:

For a wider reach, FinTechs should coach. Finances excite too few consumers, as most view money management as a daunting, complex chore. FinTechs so far have done a good job of showing that investing, budgeting, and saving can be fun (thanks to gamification). Now, they need to help customers build their skills even further. FinTechs can’t grow if their customers remain bad with money. So it’s time to teach (but not to preach).

We found people don’t always want to be spoken to like a ‘customer,’ but engaged with as the breathing, living, well-rounded human beings they are.

- Intuitive, intelligent tools will drive the growth of your user base. Empower your customers with engaging tools that will help them master different aspects of finance. Offer analytics, calculators, predictors, and estimators to show them where they stand now and what it will take to meet their goals. Deploy generative AI assistants to help them close that gap.

- Align customers’ day-to-day needs with the financial products you’re offering. The latest digital trends dictate a move from reactive to proactive offerings. Thanks to advances in AI, you can now anticipate consumers’ needs and capture their day-to-day struggles with high precision. What FinTechs are missing so far is the ability to pitch the best offer to the customer at the right time.

- Prepare for autonomous finance. It’s happening. The question is, Will you be at the forefront of the innovation?

Voice and virtual cards: A rising payment method duo

Conversations like the one shown above are inevitable in 2024, as Alexa now knows how to track utility bills, send reminders, compare month-to-month payments, and give personalized financial advice.

Considering previous tech advancements in the voice payment space, we expect that other voice assistants will pick up new skills and take a more proactive role in payments, money management, and other consumer finance trends in 2024.

In particular:

- Businesses will optimize their websites for voice searches and have more appealing and well-designed voice user interfaces (VUIs). Given that the global voice recognition technology market is expected to be worth around $50 billion by 2029, FinTechs that incorporate VUI design can capitalize on this key trend.

- Voice assistants will provide conversational support and basic updates. They’ll be able to reply to common queries, provide basic account/balance data, send reminders, set up recurring payments, and more.

- Voice assistants will validate and authorize transactions. Some financial institutions are already using voice as an authentication method, and voice payments are no longer a novelty.

- AI-powered tools will delight us with new skills. More advanced use cases will let users perform a wider range of activities, such as setting up recurring payments, cancelling subscriptions, and moving money between accounts.

Connected car commerce is growing as newer vehicles come furnished with connectivity and integrated payments. Since browsing and driving is bad practice, most drivers choose to place orders by voice.

In short: Voice payment technologies had a slow start, but they’re expected to pick up speed in 2024. For FinTechs, the best opportunities will lie in connected car commerce and conversational AI assistants.

Virtual cards are another not-so-new but rising FinTech payment trend. After all, the volume of credit card fraud is far from decreasing. With the latest series of high-profile card breaches, consumers feel wary of disclosing their information to just anyone.

In fact, most connected consumers use digital wallets (PayPal, Venmo, Google Pay, Apple Pay) to mask their card details and perform transactions securely. Or they opt for a virtual card if one is available from their digital bank.

Offering virtual cards is a quick way to delight customers and stave off the competition from FinTechs who are making a cautious foray into the payment card space:

- Apple Card entices users with cashback, interest-free credit for Apple products, and no fees.

- Google Wallet has also started offering one-time virtual cards.

However, the real revenue opportunity for virtual cards is in the B2B payment space.

35.8 billion was the global volume of virtual card transactions in 2023, with key segments of B2B sectors being Finance, Healthcare, and Fleets.

As we shared in our digital business banking post, virtual cards are among the features most requested by customers, as they effectively address three big payment challenges:

- Speed — Topping up a card is almost instant (unlike checks), and payments also go through instantly.

- Reconciliation — All spending information is immediately visible, so managing employee expenses is less of a hassle.

- Reduced fraud — Virtual cards are useless if stolen.

In short: Virtual cards are leading the race in the corporate payment technology space. We expect to see more virtual card offerings from both challenger banks and FinTech players.

Open banking: Almost there

Open banking has come a long way since the concept was born in the UK. In the past few years, the open banking ecosystem has improved and enlarged:

- The value of open banking transactions worldwide reached 57 billion US dollars in 2023 and is expected to increase.

- In the UK, open banking payments showed a substantial increase in 2023, with total payments growing over 102% during those 12 months. In July 2023 alone, the number of active payment users grew over 10% to 4.2 million in a month, and the number of payments grew over 9% to 11.4 million.

- Top use cases for open banking transactions in the UK include account top-ups, credit card bill payments, and e-commerce.

Many banks struggle with outdated technology, being far from customer engagement trends. Meanwhile, open banking enables collaboration between banks and FinTechs, facilitating the development of modern APIs for faster funds transfers among stakeholders.

However, the general industry sentiment is that financial institutions have not fully figured out how their open banking setups will look regarding technology, products, branding, and technology. In 2024, regulatory trends worldwide show that governments are prioritizing instant, secure, and cost-effective transactions for businesses and consumers.

Open banking stands out as a crucial focal point in these efforts, first of all in the UK and the EU, which are the leaders in open banking:

- New oversight arrangements by the Joint Regulatory Oversight Committee (JROC) promise clarity for FinTechs regarding the open banking payment services they provide to businesses and consumers.

- A JROC-sponsored pilot for Variable Recurring Payments begins in Q3 2024, targeting utilities and financial services.

- The National Payments Vision is set to maximize the benefits of open banking and real-time account-to-account (A2A) payments.

- The proposed Payment Services Regulation (PSR) and Directive (PSD3) aims for better APIs and smoother payment initiation.

- The Instant Payments Regulation, adopted in Q1 2024, aims for universal real-time euro payments within two years.

- Operationalization of the SEPA Payment Account Access (SPAA) scheme enables new payment options.

- Coming into effect in March 2024, the EU’s Digital Markets Act will grant merchants on specific BigTech platforms access to new FinTech payment methods, including open banking payments.

As regulators deliberate on the concept of open banking, here are some bare facts to prove open banking is one of the lasting trends in FinTech:

- $57 billion — total value of open banking transactions in 2023

- $330 billion — expected total transaction value in 2027

- 479% — expected FinTech market growth from 2022 to 2027

Plus, consumers who appreciate a connected customer experience are up for at least trying open banking:

- 50% — Share of millennials who report that the availability of open banking connectivity features highly influences their choice of merchant or provider.

- 48% — Share of consumers who received a larger number of payouts who said connectivity features are their preferred way to receive funds.

In short: Becoming PSD-compliant might feel challenging. But it is imperative in 2024 if you want to stay competitive and adopt new business models such as marketplace banking.

Regulation trends in financial services

PSD2 (in force since 2018) as well as PSD3 (its upcoming successor) are the top-of-mind compliance hurdles for FinTechs in the EU. Let’s look closely at them.

PSD2 mandated European banks to share data with licensed FinTech firms, paving the way for open banking in Europe.

PSD3 aims to refine existing data sharing and security standards, focusing on improving API quality. Proposed changes include stricter requirements, minimum functionality standards, and measures to tackle high latency issues. The regulation is expected to be finalized by late 2024.

PSD3 proposes some much-needed changes:

- Addressing regulatory gaps and boosting rules on transparency, liability, and open banking

- A focus on Strong Customer Authentication (SCA) to enhance transaction security and combat fraud in the payments industry

- Adjustments in data sharing practices and authentication methods to ensure compliance and promote consumer protection

- A shift in liability regarding fraud, encouraging payment service providers to maintain high-quality services and safeguarding payers from technical malfunctions

- Exemptions for certain transactions, like merchant-initiated and mail/telephone orders, to streamline processes and benefit sectors such as travel and subscription services

- Accessibility provisions to ensure that authentication methods cater to vulnerable consumers, promoting inclusivity in digital payments

Source: KPMG – Regulation and supervision of fintech

Overall, the PSD3 report proposes several sound steps that would ease FinTech operations. The strong focus, however, remains on customer data protection and customer privacy.

US regulators are taking a somewhat different stance on FinTechs.

The US has traditionally been of the approach that we’ll try to fit [FinTech] into one of our regulatory boxes.

Navigating regulation trends in the US remains complex, with each state imposing its own laws, hindering nationwide FinTech services. Despite technological advancements, a significant portion of US consumer finance trends still rely on traditional banking methods. Despite these challenges, US FinTechs attract substantial capital, evidenced by eight out of the ten largest FinTech deals of 2023 being registered in the United States.

On a brighter note, US authorities have tried to boost the financial industry by introducing the FedNow service.

Let’s see how US regulators are going to play FinTech catch-up in 2024.

Intellias regulatory insights:

Most FinTech operations in the US are governed by outdated legislation such as the Gramm–Leach–Bliley Act (1999), the Fair Credit Reporting Act (1970), and the Electronic Fund Transfer Act (1978), among others. Clearly, these are hardly suitable for today’s reality.

Last year, FedNow was launched by the Federal Reserve, and now they’re hustling to get more banks on board with the instant payment service. The Fed’s goal is to make real-time A2A payment solutions widely available, benefiting both consumers and businesses across the US.

FedNow allows banks and credit unions to make real-time transactions, making fund transfers smooth around the clock. Customers will appreciate getting their hands on cash faster, simplifying bill payments, and better managing cash flow. Still, we’ll have to wait and see if financial institutions will widely adopt FedNow in 2024.

Another step is from the Consumer Financial Protection Bureau. They’re set to wrap up the Personal Financial Data Rights rule by autumn 2024, giving consumers more control over accessing and sharing their financial data with third parties in a structured and protected manner.

Still, it won’t be easy for US initiatives to fill in the gap while the EU and the UK are heavily exploring the top guidelines we discussed above. PSD2, SCA, and the GDPR may be daunting, but they aim to increase market-wide security standards and promote secure data exchanges between all participants.

We also want to highlight Australia’s regulations and FinTech trends. In Australia, the New Payments Platform (NPP) is leading the charge in real-time A2A payments. Additionally, by mid-2024, the government plans to start reviewing the Strategic Plan for Australia’s payments system, focusing on upgrading payment infrastructure and boosting competition and innovation, particularly in payment initiation.

What’s next for FinTech?

Ultimately, this is a question for you and your customers to answer.

- Listen closely to demands.

- Anticipate your customers’ next moves with better analytics.

- Impress customers with innovative products like alternative lending software.

- Align your products and offers to your customers’ lifecycle of financial needs.

- Earn trust through a transparent and seamless experience.

- Among other rising consumer FinTech trends, consider GenAI, especially to predict and meet evolving customer needs.

- Respect customers’ privacy and seek consent.

- Prioritize your tech investments and product development on all of the above.