Shopping has become an ambient experience. Phone, tablet, a casual in-store visit, click-and-collect order — the number of touchpoints between retailers and consumers grows at breakneck speed.

That should be a good thing because more engagement channels mean more sales and higher revenue.

Yes and no.

Omnichannel shoppers can spend 1.5X more on groceries than in-store only shoppers, but they also spread their dollars to up to twice as many retailers.

Rising costs of living, paired with a never-before-seen abundance of product and choice accessibility, make consumers more selective with how, when, and where they shop. We browse and research when in-store. Purchase online and return in-store, only to grab another item on the go.

At every step of this circular offline to online and vice versa journey, consumers expect to receive delightful, personalized experiences. Or else they’ll take their money elsewhere.

To survive and thrive in this multi-touch, experience-led environment, retailers need a unified commerce strategy.

What is unified commerce (and what it’s not)?

Unified commerce is a tech-led strategy for integrating multiple sales channels (in-store, web, mobile, and social) into a single platform to create homogenous customer experiences across every touchpoint.

In this context, a unified commerce experience is less about giving shoppers more channels to engage with and more about ensuring consistency in brand interactions and sales experiences.

In a unified setup, customers get the ability to effortlessly switch between channels, payment, and delivery methods. While the retailer maintains a 360-degree view of their identity and can offer personalized service wherever and whenever they need it.

Simply put, unified commerce fills in the gaps in data visibility, process execution, and technology that stand in the way of delivering better customer experiences.

Retailer processes are spread across multiple disjoint systems (POS, inventory management, RAMA, ERP, and so on), which don’t “speak” with each other. And neither do the teams working at the front and in the back of different locations and in charge of multiple digital channels.

76% of customers expect consistent interactions across departments, yet 54% say it generally feels like sales, service, and marketing teams don’t share information.

For shoppers, this type of informational asymmetry translates into poor online and in-store experiences: frequent product stock-outs, no personalized promotions, poor assistance in-store, and other mild unpleasantries that prevent conversions.

For retailers, a lack of end-to-end visibility and process execution means higher operating costs, higher customer acquisition costs, declining sales figures, and low workforce performance.

The end goal of every unified commerce strategy is to bring together all aspects of brand marketing, merchandising, promotion, inventory management, and payment experiences under a single, data-driven platform that powers all retail operations.

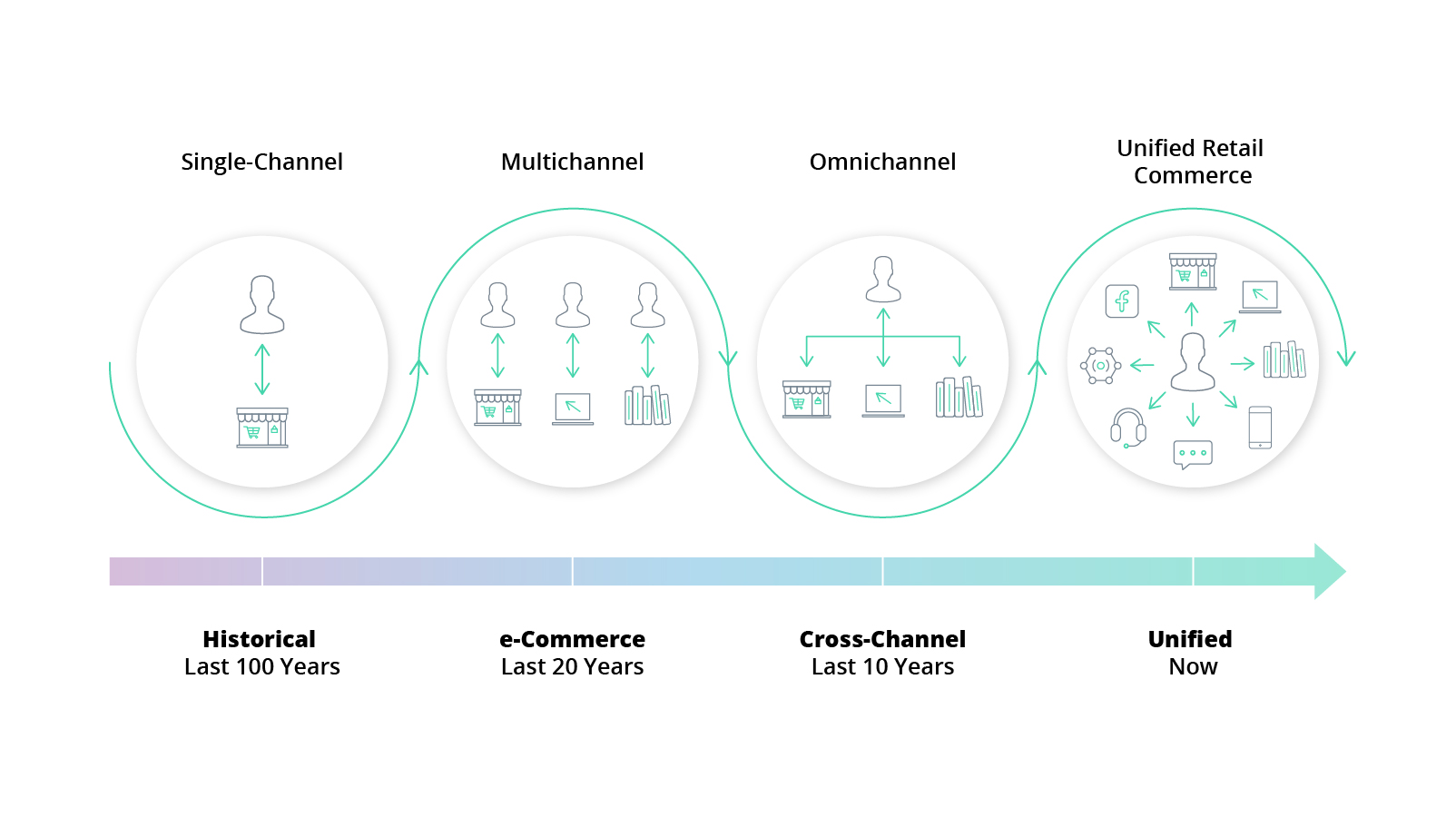

Omnichannel vs unified commerce: The evolution paradigm

To frame the discussion about why unified commerce is the next evolutionary step in retail,

let’s pedal back to the past for a moment.

Modern retail has been booming for over a hundred years. Though the premises stayed largely the same — exchanging goods for money — the process of how we shop evolved a lot.

In the early 20th century, department stores emerged in big metropolises. The concept of “the customer is always right” became popular and retailers rushed to bedazzle shoppers with art-deco interiors, gourmet restaurants, and an army of knowledgeable floor-walking assistants.

By the mid-20th century, networks of retail chains sprawled across the continents, targeting a growing segment of middle-class buyers, who shop regularly for necessities and pleasure. Consumerism and conspicuous consumption flourished as global economies picked up speed.

Once home computers became a thing in the 1990s, some savvy retailers thought: why rush people into stores when you can reach them from the comforts of their homes? Depending on whom you ask, the first-ever eCommerce sale was made either by Dan Kohn — an amateur merchant who sold a music CD to his friend online — or by The Internet Shopping Network — an online website, selling computer equipment. Thus, began the era of multichannel retail.

By 2000, global eCommerce revenues crossed the $286 billion mark, with the US alone generating $10 billion in online sales during Q4 2001.

Onward, digital shopping saliently keeps eroding traditional retail. Mobile commerce (m-commerce) came to be as smartphones got bigger glossy screens. In 2015 alone global mobile commerce sales grew by 68%, reaching $155 billion, with emerging markets in China, Eastern Europe, and LatAm showing the highest growth rates.

Social media networks, seeing the surging interest in online shopping, quickly jumped onto the bandwagon. In 2016, Facebook launched Marketplace. Pinterest and Instagram shortly came through with their “shoppable” content formats. TikTok now has TikTok Shop. YouTube has Youtube Shopping.

The Internet slowly evolved into one giant shopping mall and retailers rushed to capitalize on all the new opportunities available for targeting, nurturing, and selling to consumers.

By 2015, the era of omnichannel commerce started to gain shape.

A 2017 study of 46,000 US customers found that only 7% were online-only shoppers and 20% were store-only shoppers. The majority (73%) were omnichannel customers.

Omnichannel commerce emerged as a multi-channel sales approach, where retailers

expand their presence across channels to support more complex customer journeys.

But in the pursuit of more channels, retailers inadvertently created an unhealthy dynamic of the digital channel(s) becoming a bolt-on to much older, brick-and-mortar-focused operations. Insufficient integration between channels posed inventory management and data synchronization challenges. Channel conflicts started to emerge within larger retail companies, with competition being even more intense with the outside world.

Moreover, digital channels were growing more expensive to maintain and the promised ROI of “higher sales volumes” and “stronger conversions” failed to materialize.

The great promise of omnichannel retailing for consumers was a smooth transition between digital and physical shopping. Yet, retailers couldn’t figure out how to deliver it.

A 2016 study by McKinsey found that only 21% of retailers considered delivering “a unified multichannel experience” to their shoppers, whereas 79% were either “still figuring that out” or “getting there”.

The top-three roadblocks to implementing omnichannel experiences were missing customer analytics capabilities across the channels (66%), siloed organization (48%), and poor data quality (45%).

OK, but surely with all the titanic shifts in eCommerce (especially post-pandemic), matters got better?

Not quite.

Retailers still struggle to get omnichannel right. A 2021 study by Forrester said that 85% of Canadian retailers still lack a seamless omnichannel experience. The reason? Inability to extract actionable insights from available customer data.

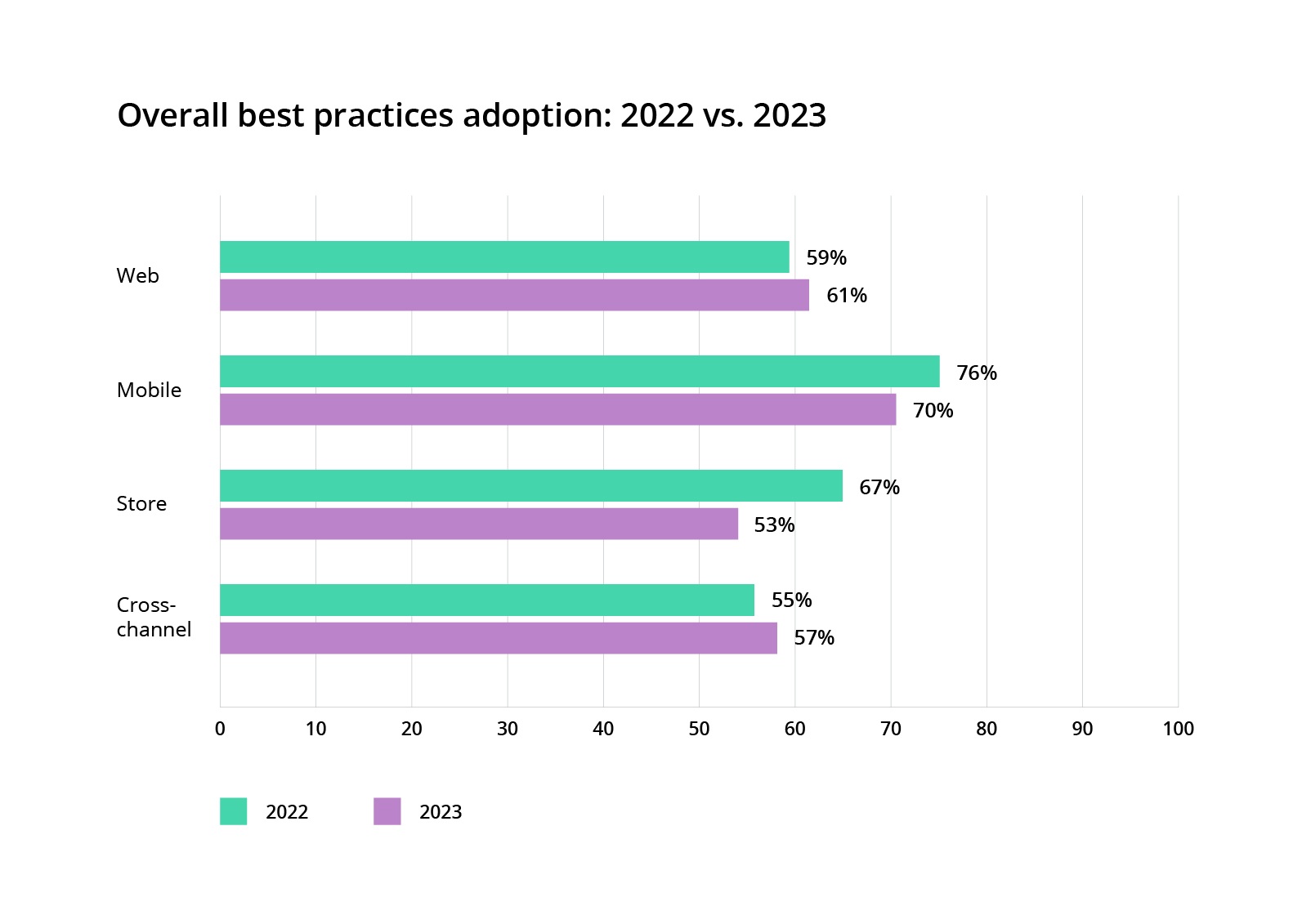

The 2023 Omnichannel Retail Index by OSF Digital, which benchmarks the performance of 115 leading U.S. global retailers, found that most companies scored an average of 60% across the adoption of best practices.

Source: OSF Digital — 2023 Omnichannel Retail Index.

What’s interesting is that some ratings have dropped compared to 2022, which means that retailers struggle to meet evolving customer expectations.

Issues around data availability, tech constraints, and siloed retail systems are known constraints. But the ever-evolving retail landscape throws new challenges to the mix: logistics issues, rising inflation, labor shortages, and increasing supply-side costs.

CIOs are facing increased pressure to deliver digital dividends here and now. They must focus on technological innovations with proven ROI potential to engrain the future digital vision in different parts of the enterprise.

Unified commerce emerged as this strategic shift in focus from deploying more channels to ensuring that they work best in unison. It’s a cultural and technological merger of previously disparate processes into one data-driven operational ecosystem.

Key differences between omnichannel vs unified commerce

| Omnichannel commerce | Unified commerce | |

|---|---|---|

| Approach | Multi-channel availability, achieved with surface-level integrations. | Consolidation of all channels into an integrated operating system. |

| Data visibility | Fragmented and siloed between teams, channels, and markets. | Complete view of the business available to every division. |

| Integration | Channels operate largely independently, with ad-hoc data exchange processes in place. | Full integration of all channels and business systems through a shared data exchange platform. |

| Customer experiences | Stronger emphasis on channel-specific optimization with seamless transitions being a secondary focus area. | Stronger emphasis on personalization and consistency of customer experiences across all channels. |

| Scalability | Deployment of new channels requires extra integration efforts. | Deployment of new channels and touchpoints can happen at faster speeds. |

| Tech infrastructure | A portfolio of often disjoint business systems for different channels and functions. | A platform of loosely-coupled, yet fully integrated software modules. |

Three pillars of unified commerce strategy

In today’s setup, we have retailers with multi-market branches, spanning continents, and ever-growing tech portfolios of “solutions” for this or that.

On the other hand, there are shoppers for whom it’s the quality and convenience of brand interactions that matter—not how or where they are delivered.

The goal of a unified commerce strategy is to fill in the experience lacunas left by earlier omnichannel efforts to enable seamless, bilateral passages between online and offline channels.

In this way, unified commerce promotes a more holistic approach to organizing retail processes and tech architecture for supporting them.

Unified front- and backend operations

Consistent experience between in-store and digital channels is one of the key components of unified commerce delivery. Frontline employees are as knowledgeable as online help resources. Products can be purchased off-the-shelf, ordered for delivery, or programmed for in-store pickup.

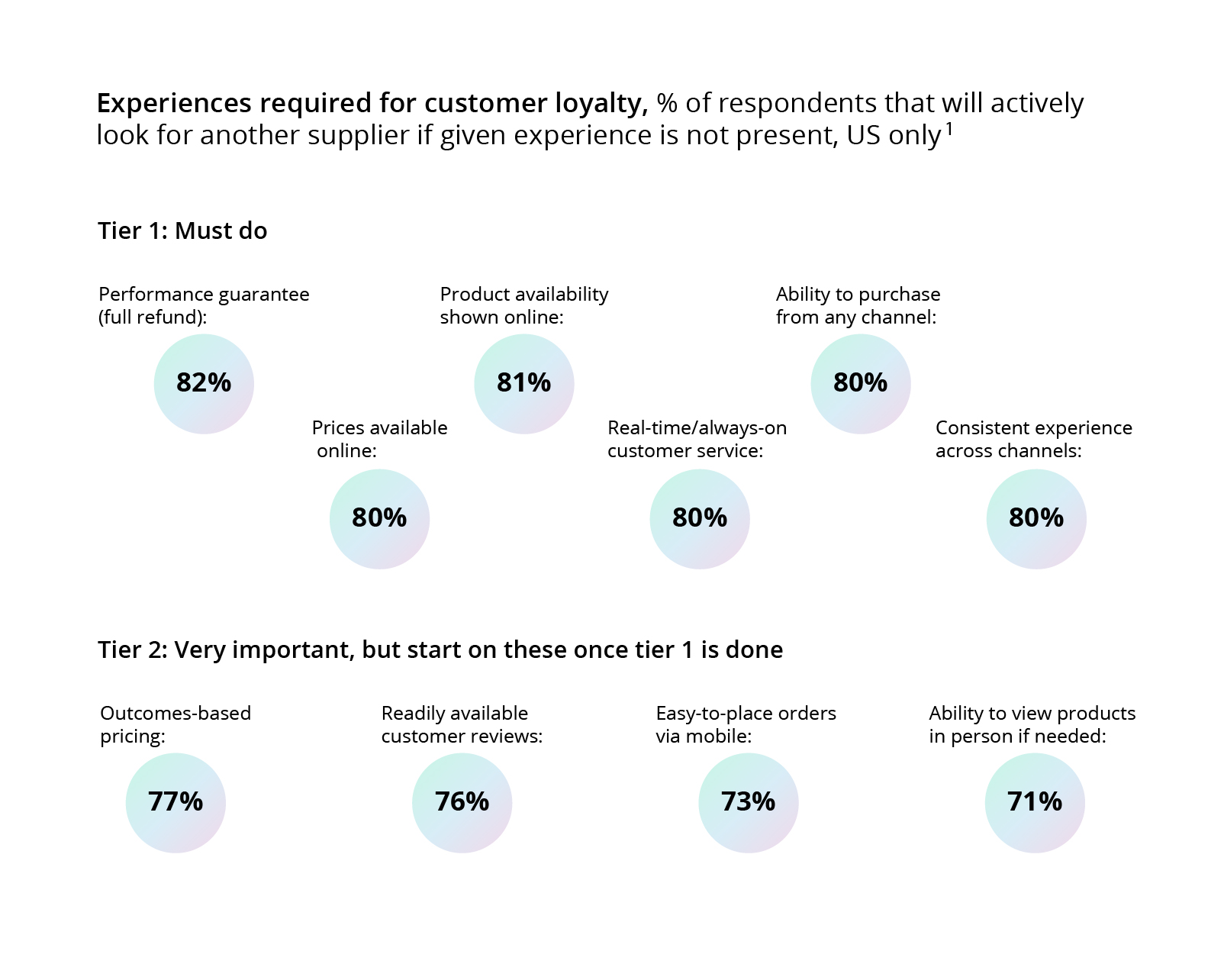

Uniformity is what modern shoppers expect. Among US B2B customers, 80% say that they will search for another supplier if the “ability to purchase from any channel” or “consistent experiences across channels” are not present.

Source: McKinsey — B2B sales: Omnichannel everywhere, every time.

Haphazard adoption of digital channels and lack of alignment between front-end experiences (e.g., customer service, assortment selection, promotions), and backend processes (e.g., inventory management, pricing strategy, delivery management) prevent retailers from delivering on that want.

Let’s picture Janine, an average shopper, looking to buy new cleaning supplies for her business.

She’s busy and wants to get all the wares she needs from one place. When she checks with the first retailer, no product stock information isn’t available online. She doesn’t want to waste time on a pointless in-store trip.

The second retailer says she can order all of the selected goods for click-and-collect on the product page, but during checkout, several products in her basket aren’t available at the selected store.

Frustrated, Janine goes with her third contender. Their prices are higher, but the website immediately tells her which products she can pick up in a nearby store on the next day. For the remaining items on her list, the app offers to place an in-store delivery within two days.

When Jamie arrives to pick up her consolidated order, she chats up with the store assistant, who suggests a couple more goods for her business (using the order information) and Jamie buys those recommendations on the spot.

One in three consumers says they will shop again with a brand if they had a good experience, even if there are cheaper or more convenient options. Moreover, consumers are ready to pay up to 16% in price premiums for better customer service.

To deliver better CX, the customer front end and the retailer back end need to be technologically aligned. In other words, the backend systems must be designed to support desired customer experiences, rather than just exist to power standard operating procedures.

Customer experience alignment on the technology level

| Front-end (Customer) | Back-end (Retailer) | |

|---|---|---|

| Merchandising | Good product selection, personalized recommendations; ability to easily locate preferred goods. | Localized product assortment per branch, optimized product selection by channels, analytics-driven up-sells/cross-sells. |

| Inventory | Option to verify product stock online/in-store, timely re-stock updated, alternative ordering options (“endless aisle”) | Unified inventory management system, demand-driven stock planning, timely re-stocks, driven by real-time sales data. |

| Labor | Competent assistance is available in-store and online. Tailored advisory, based on preferences, past purchase history, and loyalty status. | CRM system offers a 360-degree view of the customer, integrated with customer service tools and in-store customer/employee devices. |

| Pricing | Fair, competitive prices. Relevant sales offers and promotions. | Dynamic pricing software with advanced sales forecasting and price optimization capabilities. |

| Scalability | Deployment of new channels requires extra integration efforts. | Deployment of new channels and touchpoints can happen at faster speeds. |

| Fulfillment | Wide selection of delivery methods. Efficient order pick-up experience. | Integrations with multiple 3PL and logistics partners; data-driven in-store fulfillment hub. |

| Returns | Easy, channel-agnostic return experience. Fast refunds. | Strong reverse logistics function, and instant payment processing. |

Experience-led

In a typical retail landscape information circulates in silos. For example, order information is stored separately from the data about the customer who placed it. Because different retail teams lack visibility into data they cannot deliver seamless, consistent experiences that modern shoppers desire. Moreover, data disparity creates operational issues.

Let’s take deadstock — a pervasive industry issue. Everyone knows why it accumulates (over-supply, poor merchandising practices, subpar demand predictions, etc). But far fewer retailers know how to combat it effectively.

Why? Because they struggle to understand what their customer bases want on market-, channel-, and even -store levels.

Unified commerce solutions tackle the visibility problem in two ways:

- Unified data governance and exchanges

- High-precision analytics

Take it from a grocery chain, CUB. Due to inventory inaccuracies and subpar forecasting capabilities, the retailer struggled to right-size its inventory. Excess waste and missed sales opportunities due to stock-outs were common. The team ran a 3-month pilot of using

AI-driven inventory management and order recommendations with Afresh. During it, CUB saw a 2.5% sales lift while also reducing inventory holds by 7.4%, leading to 6.7% faster inventory turns.

Fashion retailer River Island saw similar success with AI-driven merchandising. After implementing Nextail’s solution, the stockout rates dropped by 23.7% for continuity products and the team recorded a 28.3% reduction in lost sales.

Apart from optimizing inventory and merchandising strategies, better data availability and advanced retail analytics also help:

- Identify customers across channels

- Understand their customer behaviors

- Manage cross-channel interactions in real-time

- Target the best segments for acquisition

…And ultimately deliver personalized customer experiences at every step of their journey.

Online retailer Zalando, was among the first to implement data-driven personalization on its marketplace. Among its AI assets, Zalando counts an AI-powered sizing tool, which recommends the best size to customers across brands based on size-related returns data. In 2018, Zalando also launched an AI-powered digital outfit recommendation tool, initially trained on data from Zalon, the retailer’s curated shopping service. It also relies on the user’s “wishlist” items to create personalized suggestions, plus teams’ feedback. The new tool drove 40% larger shopping cart sizes since its deployment.

Unified commerce helps create experience-led operations through better data visibility, which leads to a greater understanding of the business performance, market drivers, and customer behaviors.

Composable

Omnichannel strategies left retailers with many disparate systems. The goal of unified commerce is to unite them, but this unification doesn’t mean a full merger into one monolith block. On the contrary, it assumes the creation of different composable “building blocks” for your organization.

Composable business means creating an organization made from interchangeable building blocks. The modular setup enables a business to rearrange and reorient as needed depending on external (or internal) factors like a shift in customer values or sudden changes in the supply chain or materials.

On the backend, composability in technical architecture enables retailers to better balance load across applications, isolate sensitive data, and embed extra capabilities without causing havoc to the entire platform.

On the front end, composability allows retailers to build autonomous, portable solutions from the backend functionality.

For example, data from an inventory management system can be packaged into an API to create a real-time on-site widget for checking in-store product availability. Likewise, some portion of CMS data can be exposed to power personalized product recommendations, based on purchase history. By strategically reorganizing parts of your retail systems as APIs and microservices, retailers accelerate faster to their targets.

Case in point: In 2020, Nike set a target of having 30% of total sales come from eCommerce by 2023. But they completed this goal in one year. The company now eyes 50% digital penetration any day soon.

How did Nike manage to accelerate its eCommerce? The company has built out a system of “composable platforms that unite strategically related global business capabilities that are implemented by modular and composable technologies exposed through APIs.”

In real life, that’s Nike’s direct-to-consumer (DTC) digital marketplace, as well as a growing network of online-to-offline services, as well as phygital experiences through store concepts such as Nike House of Innovation, Nike Rise, Nike Live, and Nike Unite. According to the Q2 2023 earning report, total revenues were up 17% compared to the prior year. NIKE Direct sales reached $5.4 billion (up by 16%) and NIKE Brand Digital sales increased by 25%.

Peeking under the hood: What is a unified commerce platform?

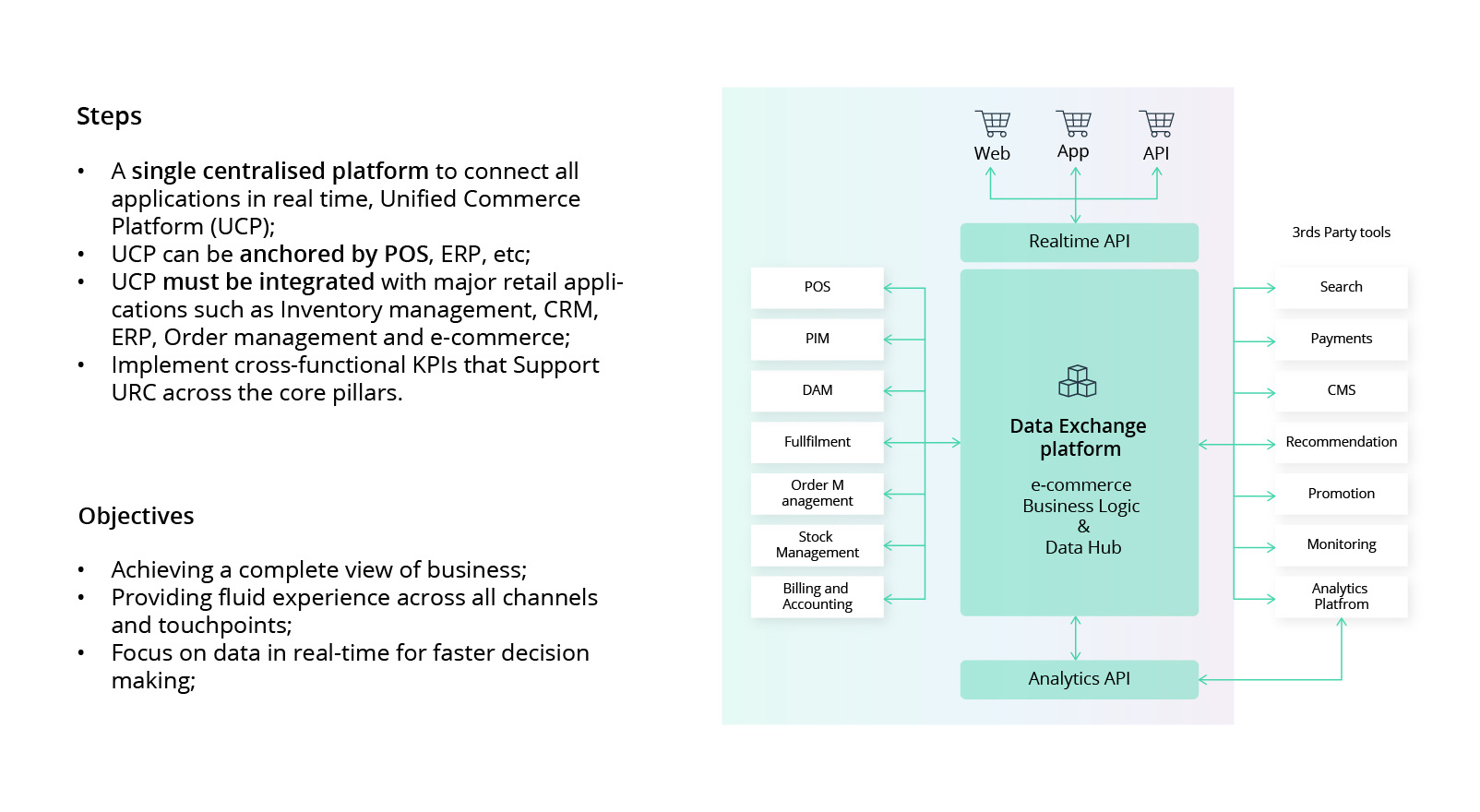

Unified commerce strategy assumes both operational and technological changes as both are now connected at the hip. To deliver better customer experiences and operational improvements, retailers need to get their technical infrastructure in order.

A unified commerce platform (UCP) is a software architecture pattern, which connects your backend systems with customer-facing applications via a centralized data exchange platform. It defines how different software components interact with one another. Unlike earlier retail architectures, UCP prioritizes modularity (via microservices), connectivity (via APIs), and interoperability (through reusable toolchains and tech components).

Digital platforms can have multiple, loosely coupled components, written in different programming languages or purchased from different vendors. What unites them is a shared data management infrastructure. The data exchange platform routes data to applications that consume it — be it RAMA, CMS, or self-service BI tools.

Unified commerce platform architecture helps:

- Streamline data exchanges between different systems

- Maintain a unified view of customer journeys

- Automate standard operating workflows

- Unlock more insights for decision-making

So that your company could offer consistent, on-brand experiences across touchpoints by using real-time data and pre-made components for new feature development.

By 2026, 80% of software engineering organizations will establish platform teams as internal providers of reusable services, components, and tools for application delivery.

Advantages of unified commerce architecture

Platform development is a substantial tech investment. Consider the outcomes it will produce when justifying this decision.

Lower TCO

Monolithic retail architectures hinder agility and upgrades while driving up overall expenses due to aging applications. Microservice-based architecture offers retailers greater scalability at faster speeds and a lower cost.

With platform development, retailers don’t need to “rip and replace” all systems at once. Instead, you can expose data and functionality from existing applications to the new ones to secure “quick wins” and then modernize core systems.

Brazilian retailer player prioritized the transformation of all customer-facing business capabilities before upgrading its monolith backend. In particular, they focused on deploying a digital marketplace, which gained major traction over four years and increased the company’s stock prices by 18,000% in value.

Higher data visibility

Data silos are a bane of every retailer. Most information is fragmented across systems or rests in hard-to-access on-premises systems with limited scalability. Variety in data types, formats, and storage systems also makes it hard to deploy and scale retail analytics use cases.

Unified commerce solutions can be architectured without physically moving data. Instead, you can create a scalable data architecture for querying data from various connected sources and consolidating the essential insights into a centralized repository. With a “single source of truth” established, your teams can gain a 360-degree view of the customers and their behaviors across channels.

Moreover, you can use other operational data (e.g., on inventory, sales volumes, demand, and supply) to improve back office operations — from local assortment management to equipment monitoring.

Intellias has recently helped a Baltics supermarket chain deploy a big data platform for refrigerator and freezer equipment monitoring. With 200 stores and multiple assets, the retailer was losing thousands of euros’ worth of spoiled food overnight due to malfunctioning equipment and faced steep repair costs.

The new platform receives data from in-store sensors across the store network and immediately alerts staffers about temperature issues. Frontline employees can take immediate action, while managers can review extra insights around equipment performance. Thanks to the new platform, the retailer also saved 20% of energy consumption across its supermarket chain by adjusting the temperature settings.

Better user experiences

Software legacy is also to blame for poor user experiences (UX): slow-loading pages, glitch-outs, and downtime, especially in busy shopping seasons. A 2022 analysis of 200 UK multichannel and pureplay retailers found that 88% had poor page speed on mobile and 70% needed to make speed improvements for desktop.

Low system performance also restricts your ability to launch new competitive features that consumers want (e.g., in-store availability verification or same-day click-and-collect) as they risk breaking the already shaky technical infrastructure.

Unified commerce solutions prioritize the principles of composability, which allows for creating redundancies for force majeure events, plus isolating the impacts of individual system component failures from affecting the entire system. Moreover, the right architecture provides sufficient elasticity for accommodating spikes in demand and ensuring undisrupted business continuity.

Our team has recently worked with a global Fortune 500 manufacturer and retailer, servicing 150 million users worldwide. For the company, any extra minute of system downtime translates to significant operational losses. As the customer’s customer base grew and the network of distributors, stores, and other retail outlets expanded, they need to implement extra reliability in their retail platform. Our team has helped them implement robust, scalable, and optimized AWS cloud infrastructure to power their retail operations.

Personalization at scale

Experiences, powered by proprietary data, are hard for competitors to imitate. Your company knows your customers like no other and has the ability to engage and delight them at every step of their journey.

A UCP helps consolidate customer knowledge to build better audience profiles, precise segments, and personalized purchase paths for different customer cohorts. This intel can be then distributed across teams and channels, plus transformed into new customer tools and offerings.

For example, our client, a Fortune 500 consumer goods company, wanted to learn more about their customer behaviors and product usage in particular. However, the company lacked visibility into the consumption patterns. The company launched a smart device for data collection and Intellias has helped the company fine-tune its device to capture the right type of insights and architectured a new cloud platform for streamlined data processing and analysis.

With the developed solution, the company could capture richer insights and use them for experience personalization, leading to increased customer loyalty and revenue growth.

In addition to providing high-tech eCommerce features, the new customer engagement platform assists our client in reaching new markets.

Overall, 49% of consumers say they will likely become repeat buyers after a personalized shopping experience with a retailer. Companies that deploy personalization with a large segment of their customer bases also see a reduction in marketing and sales costs by 10% to 20%.

Acting as a united front (and back)

Unified commerce will be a central pillar of future retail operations: phygital, personalized, customer-focused, and profitable

To arrive at this future state, retailers will need to reassess their channels and build new tech bridges between them. Inventory management systems should link up stores and fulfillment centers together, enabling enterprise-wide tracking and reporting capabilities. Retail assortment management systems should mesh point-of-sale data with inventory insights, pricing, returns, and exchange insights for tailored assortment suggestions.

Data accessibility and real-time connectivity are the keys to delivering seamless, omnichannel experiences consumers expect from their favorite retailers.

Intellias helps retailers re-imagine their operations with the help of technology. Contact us to explore the future of unified commerce together.