Banks are pressured to engage in this new balancing act:

Doing business-as-usual is already hard as FinTechs and TechFins encroach on your territory. But switching to business-as-unusual — with all those fancy buzzwords like AI, big data, ML, and chatbots — brings the pressure even higher.

Especially, if you are yet to get a solid buy-in for your bank digital transformation strategy. Heck, you are not even sure where to begin in the first place!

Every digital transformation strategy for banks has a lot of spinning plates (read legacy systems & processes in dire need for upgrades) and loads of uncertainty (will this work, will this fail, or will I get fired for trying?).

But standing aside and watching your competition whizzing past isn’t an option, right? After all, your future company vision isn’t one of failure. Warning: 80% of heritage financial services can become obsolete — exist formally without being competitive, become commoditized, or go out of business if they fail to pursue digital transformations.

That was the scary part. Now comes the good news — successful digital transformations in banking are not mysterious, vague, or moonshot projects. Most involve rather concrete steps and areas of transformation.

Beyond the buzz: the two core areas of digital transformation in banking

Every bank has two main “business blocks”:

- The front office— customer-facing solutions, aimed at enabling digital sales, boosting retention, loyalty, and customer lifetime value.

- The back office — inner IT systems that are supporting core operational processes.(yes, there’s the middle layer, but we’ll leave it out of the equation for now)

As you’ve noticed in the title, this is Part One in the series. And we’ll start with helping you get your front house in order.

Why a connected customer strategy should drive your bank digital transformation

As we proclaimed back in January: 2020 is going to be the year of the connected consumer in finance.

Millennials and Gen Zs are growing their disposable income and personal wealth. FinTech product adoption is surging. When you pair these two facts together, it’s obvious that to stay competitive every bank will need to set a higher CX bar.

And the ‘secret sauce’ to delivering that superior customer experience is both simple and complex — emotional connectivity. As leading technology brands, such as Apple, Amazon, or Google, have become the gold standard for digital engagement, many consumers now have a stronger emotional connection with these brands than they have with their primary banks. If banks want to keep up, they have to engineer the digital experience they offer to make these emotional connections, which, ultimately, could translate into sticky interactions and more profitable customers

Forging a strong emotional bond with your customers results to a cascade of business benefits:

- Over their lifetime, emotionally connected consumers end up being 52% more valuable than their highly satisfied peers.

- In the Deloitte study, the top 25% of respondents who ranked their primary bank positively also hold the most financial products with their bank.””

- Emotionally connected credit card consumers have a higher annual spent on their cards and end up being 8 times more valuable than highly satisfied ones.

In other words: emotional connectivity is key for boosting customer retention, loyalty, and profitability in finance.

To nurture that bond, banks need to figure out how to deliver top-notch convenience, quality, and value via the digital channels, the same way the customers’ favorite brands such as Apple, Amazon, and Uber do.

An exceptional digitally-driven consumer experience, infused with hyper-personalization, can become your main brand differentiator.

The key elements of a winning connected customer strategy for banks

You can’t dial up affection on command. But you can add attraction-boosting mechanisms to your financial products. And yes, this involves borrowing some ideas from the sweetheart millennial brands as these are often seen as the most common point of reference for expectations.

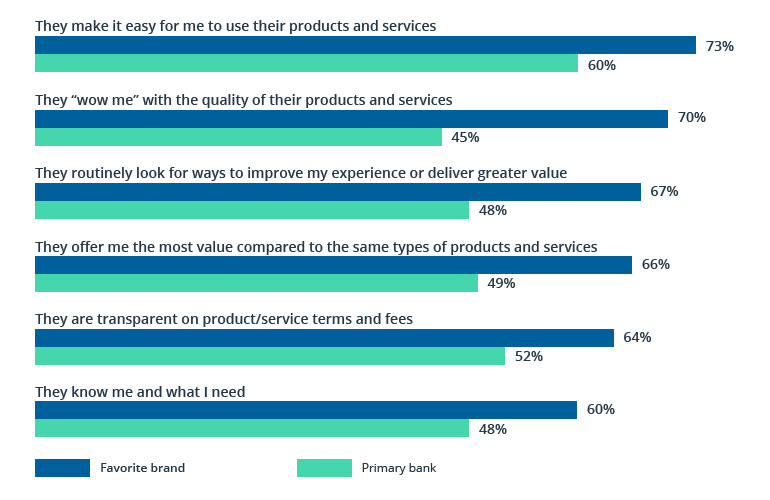

Source: Deloitte — Accelerating digital transformation in banking

So if you are plotting a bank digital transformation, prioritize the following elements in your digital banking strategy.

Develop a silky-smooth digital account opening system

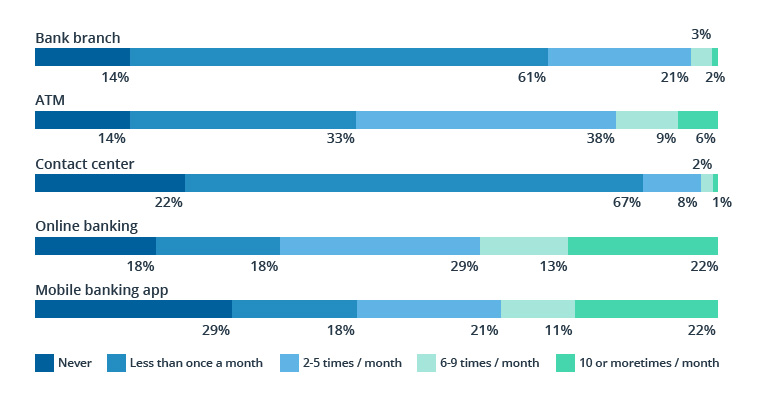

Online and mobile banking are the two prime avenues of interaction for connected customers.

Source: Deloitte — Accelerating digital transformation in banking

The first touchpoint with your brand will often be the most crucial one. That is the online account opening experience.

The perks of acquiring banking customers digitally are manyfold:

- Nearly two-times lower acquisition costs

- Higher volume of new accounts opening

- Reduced KYC and compliance costs

However, this seemingly common step ended up being the hardest to get right for traditional banks. Why?

A typical digital transformation strategy for banks would lean heavily on the technological side of things that underpins onboarding. But fewer re-think the onboarding process itself.

To get down to the bottom of things, we previously published a separate 6-step guide to creating a smooth digital onboarding system, based on our experience in working with a global bank.

Deploy a UX-friendly mobile banking app

Mobile banking growth is seeing a steady uptick globally. By 2023, mobile banking will become the biggest channel in terms of users – overtaking high street branches to claim the number one spot in the UK

In 2019, some 25 million Britons were already using mobile banking apps. That means that roughly half of current account holders reach for the phone to settle their financial affairs.

In the APAC region, the growth figures are even higher. Per The Mobile Finance Report , created by Adjust and App Annie, financial app downloads surged to 1.8 billion in 2018, up from some 383 million downloads in 2014. GSMA data further backs up this trend: in 2018 over 90 million new accounts were opened in the APAC region alone.

Though the Asian landscape has been mainly dominated by the supper apps — one-stop-shop solutions for all the users’ needs, ranging from finance to healthcare, messaging, and more. WeChat, Alipay, Line, Fave are just several examples of all-encompassing financial products that swept the Asian markets in one swipe.

While the branch and other offline services are dead (yet), they are taking a major hit from the spurring ecosystem of online financial offerings. And you’ll definitely want to be part of it. Here’s why:

- Mobile banking is a low-cost, yet highly-profitable customer acquisition channel

- Apps are great for boosting retention and introducing new loyalty schemes

- Smartphones generate a wealth of customer data that can be used in product development and marketing

- The mobile channel itself enables access to new business models (e.g. marketplace banking or alternative lending).

- In times of crisis, digital becomes an essential channel to staying connected with the customers and creating additional value for them.

Ready to get to action? Great! We happen to have the perfect formula for building leading mobile financial products.

Add analytics-driven solutions that delight, guide and educate

Migration to the digital realm unlocks access to additional customer data — one that can be put to immediate action for improving customer experience and personalization.

With predictive analytics and machine learning in place, banks can deliver truly customer-centric experiences such as:

- Highly-personalized “just for me” marketing offers and promos

- Accurate product recommendations via an online solutions wizard or in-app

- Faster (or instant) approvals for new financial products

- Next-best-action recommendations for up-sells and cross-sells

The best digital banks leverage advanced analytics to act as trusted customer companions, knowing exactly where the customer is at their journey and what types of products they need at any given moment.

Furthermore, a good fraction of new innovations in banking technology is aimed at using analytics to create new financial products such as:

- Robo advisors and automated wealth-management platforms

- Personal finance coaching apps

- Instant personal and business lending

- Instant cash advances

- Automated savings tools

- Pay-per-use travel and vehicle insurance

- Instant installment credit

- Online mortgage applications and deal comparison…and that’s just several examples of analytics-powered product development ideas.

Enable stellar digital customer support (CS)

The last (but not least!) ingredient of impeccable finance CX is customer support.

So far most financial institutions are far from excelling in the CS domain. That’s problematic for sure as according to a Qualtrics survey:

- 69% of customers who are “sure to leave” the bank name poor customer service as the reason for parting ways.

- 75% won’t mention in advance that they plan to leave as they think it “won’t make any difference”.

- 43% said that improving service levels, however, could help the bank retain them.

And the cherry on top: 70% of customers who plan to leave say it was many minor expectation failures that triggered their decision.

To reiterate — it’s the tiny things that matter the most when it comes to customer experience. Your customer support teams (and tech) are at the frontline of identifying and addressing those expectation failures and administering corrections.

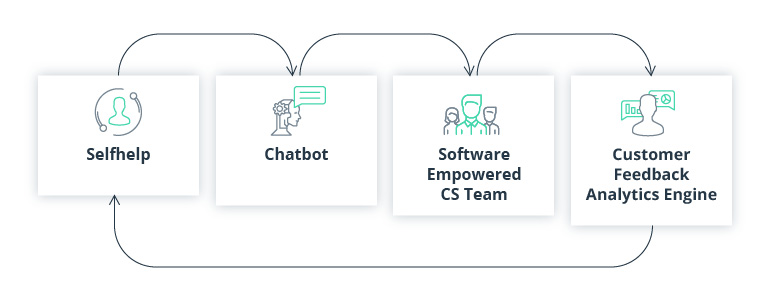

Again, strong alignment between new tech and new processes will play a key role. Here’s a quick CS framework you can borrow for your bank digital transformation strategy:

- Level 1: Create an exhaustive self-help portal addressing the common FAQs.

- Level 2: Add an AI-driven chatbot to your online and mobile banking to deal with basic customer queries.

- Level 3: Empower your web care agents with better software such as RPA apps for workflow automation or conversational AI bots pre-suggestions text, links, and information.

- Level 4: Establish a simple mechanism for collecting customer feedback, insights, and complaints and transforming them into product development insights. Also, use the same data to enhance your self-help materials and train AI algorithms.

Combining all of the above in a stellar digital banking experience

Let’s further unravel how all of these innovations in banking benefit the end-customer — Carol. Carol is a Millennial banking customer, earning over $100K per year, and looking for a new credit card with good rewards.

Wrap Up

Cooking up the right CX isn’t that hard when you have set your transformational priorities straight. That is:

- Developed a streamlined and effective digital onboarding experience for new and existing customers.

- Deployed a complementary mobile banking app to drive retention, loyalty, additional sales, and data collection.

- Prioritized new banking analytics use cases, in-line with your strategic priorities for the next 5-to-10 years.

- Ramped up your customer service levels and empower the teams with better tools.

Depending on where you are in your journey technology-wise, you may also need to upgrade your core banking systems, support IT infrastructure, and build new digital banking software. That’s what we’ll focus on in Part Deux. Stay tuned!

Ready to roll with innovations? Contact Intellias FinTech team for more insights about modernizing your customer-facing systems!