Your target audience is changing. Without mass personalization and digital-first offerings, traditional wealth management firms face a dire future. If you want your wealth management operations to remain profitable, you have to focus. You have to think about who your new target customer is, then figure out how to engage them. That’s no easy exercise, but we’ve already done some legwork for you. In the next five to ten years, roughly $30 trillion in financial and non-financial assets will be passed from baby boomers to their Millennial and Gen X children in the US alone.

With newly inherited wealth comes the responsibility to manage it. Most millennials are struggling to make sense of their cents. Only 44% answered all the questions correctly in the 2018 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), compared with 50% among all US adults.

Moreover, according to a Credit Karma survey, 46% of consumers find finances overwhelming (and let’s be honest, sometimes boring). To some extent, this explains the rapid growth of robo-advising and the personal finance management software market, which features on-demand advice powered by chatbots, gamification mechanisms, and other delightful tools that engage and educate users and help them feel less overwhelmed.

And if you’re thinking, “our primary audience is older high-net-worth individuals, so we’re safe,” hold that thought.

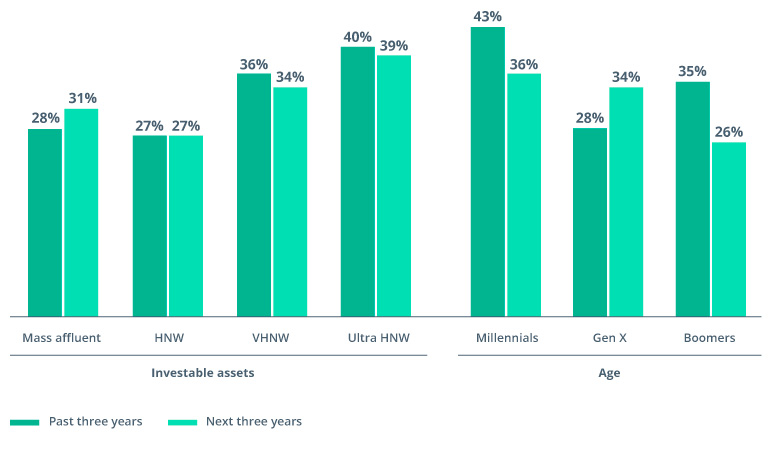

39% of ultra-high-net-worth (UHNW) clients say they plan to switch or move money from a wealth management provider in the next three years.

Source: EY, Global Wealth Management Research Report

As the data above shows, millennials are leading the switching movement, followed by Gen X. What’s even more curious is that people with little investment knowledge are more likely to switch wealth management services in the next three years compared to those with more investment knowledge (which brings us back to the previous point — educating your customers is key).

Now you may be wondering why consumers switch wealth management providers in the first place.

In most cases, the decision to change a wealth management provider is driven by a major life event

- 61% switch due to losing a job or changing employment

- 48–49% seek a new provider after getting married, having children, receiving an inheritance, or starting a business

- 43% change advisors after a divorce/separation

- 38–39% get a new advisor after sending kids to college, buying a property, or retiring

As we wrote in our New Age in Banking white paper, financial consumers (and millennials in particular) want financial services that closely align with their current needs and current life stage. Financial institutions that deliver just that stay afloat. Those who don’t sink.

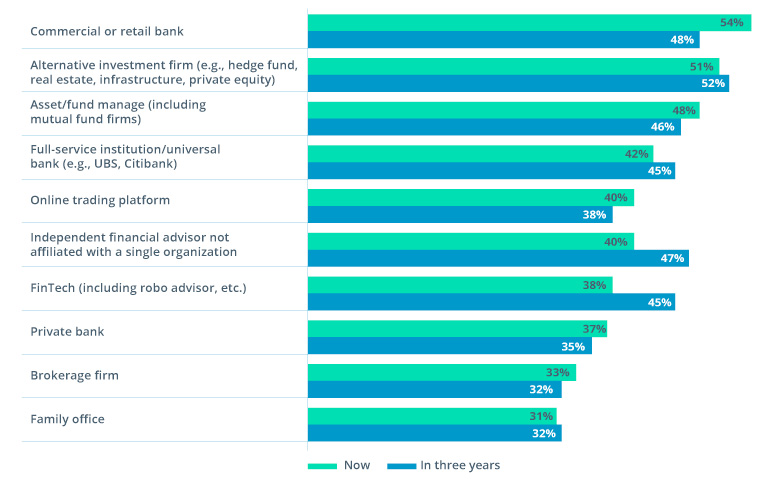

The sheer choice of wealth management services heats up the competition even further. Traditional and alternative investment firms are getting undercut by FinTechs and robo-advising platforms. Mutual funds are competing with investment banks, individual advisors, and all the other entities mentioned above.

Source: EY, Global Wealth Management Research Report

With all that elbowing, things can get heated quickly. So when the pressure is high, how can you keep your key customers satisfied?

Enter artificial intelligence in wealth management.

AI in wealth management: Use cases and opportunities

Artificial intelligence is smoking hot subjects in the wealth management space. (The last time we checked, there was at least one new report on AI/ML published every other week).

So rather than reiterating all the possible (and not-quite-so-possible) AI use cases in wealth management, we’ve grouped all the options within familiar categories: customer-facing solutions, middle-office innovations, and back-office upgrades. Let’s dive in.

Customer-facing solutions

Personalized, data-driven onboarding for new clients

Smooth digital onboarding is a major customer magnet used by digital leaders in the wealth management space. Yes, building a personal relationship with an advisor is important. But the modern pace of life doesn’t always make such courtesies possible.

Translating that essential meet-and-greet experience to the digital space is essential for financial institutions who want to stay ahead of the curve.

How can you do that? By infusing more data into the digital account opening process and using machine learning to:

- analyze the customer’s current life stage, interests, and portfolio goals

- gauge the customer’s investment style beyond the standard aggressive, conservative, or balanced boxes

- recommend the most relevant starter products or introduce relevant automated wealth management offerings

- perform AML and KYC checks in the background by pulling data from both internal and external sources.

Rather than welcoming new customers with a mountain of paperwork, impress them with a straightforward, interactive digital onboarding process (that ticks all the compliance boxes too).

Wealthfront does a great job in this department. Their new user onboarding takes the form of a progressive questionnaire that asks customers about their goals in plain language.

They then pose questions to personalize the onboarding experience even further, prompting users to connect their bank accounts and set simple goals.

The entire experience is rounded off with a list of suggestions on portfolio allocation and an overview of investment outcomes.

Real-time intelligence for advisors

AI portfolio management does not exclude human advisors from the equation. On the contrary, the goal of good algorithms is to help your advisors make the right call both at the client and company levels.

Incorporating AI and ML into advising increases the scope of predictions, prescriptions, and personalization that your organization can deliver to end clients. For example, you can provide:

- personalized next best action advice for clients at different life stages

- predictive lead scoring to identify the best prospects for new products

- advanced predictive and prescriptive financial analytics to increase your business resilience.

Prescriptive and predictive analytics for investment advice

In the future, wealth managers will be selling outcomes, not traditional investment products.

Even before the current uncertain climate, modern consumers had become reluctant to subscribe to generic portfolios. Most consumers no longer want their money to “work” — they want their money to help them meet their current goals.

The artificial intelligence wealth management paradigm is making that possible on a granular level. In a matter of a few clicks, customers can set up several investment buckets containing different types of assets:

- A safe bucket of government stocks and treasury bonds to fund their happy retirement in Costa Rica

- A liquid bucket of shorter-term investments that generate a positive cash flow annually

- A sort of burn bucket with risky stocks and crypto assets to see what works

Currently, traditional investment firms and asset management companies are losing the race toward self-service, goal-oriented investment to digital-native wealth management platforms.But a strong data management process paired with AI and ML can turn the tables.

For instance, to enable near-real-time personalized advice, Credit Karma collects over 2,600 different data attributes per user, and their proprietary algorithm makes some 8 billion predictions about the right strategy for a single customer based on their goals. That’s advanced predictive analytics in action.

Beyond robo-advising, predictive analytics in wealth management can be used to:

- perform behavior-based customer segmentation to optimize service levels

- allocate portfolios and provide investment advice based on alternative data

- improve trade execution to minimize risks and costs

- streamline investor relationship management, cross-sells, and up-sells

- optimize product–channel mixes to align marketing and sales.

Middle and back-office use cases

Enhanced risk management

While AI cannot immediately make all your advisors play fair and square, it can help you minimize the amount of potential misconduct and risky behaviors.

As compliance requirements for asset management tighten, it becomes especially important to monitor trades and cross-check all transactions on concerns and potential regulatory and security issues. AI gives your firm the ability to scale such checks and set up a variety of triggers for unwanted scenarios. Using technology to monitor risks in near real time pays off.

Asset managers that have implemented [AI/ML] techniques have seen a 55 to 85 percent reduction in time spent on trade surveillance activities and, more importantly, improved risk identification.

Moreover, as AI-powered algorithms scan all your operations, they can be configured to alert your advisors on when their advice may cross the lines of internal policies and external regulations. It’s a win-win for all.

Streamlined client reporting

Transparency on costs, fees, and trades is a central requirement both among customers and regulators. However, you can’t provide this transparency (cost-)effectively if your back-office processes are tangled, siloed, fragmented, or all of these things at once.

Robotic process automation (RPA) has come to the fore as a new solution for streamlining data management, reporting, and all sorts of research and report production activities. Machine learning takes the process one step further, allowing you to move away from simple automation and rule-based report generation and toward on-demand custom reporting.

What’s more, ML systems get smarter over time and can learn to uncover emerging patterns and hidden correlations between outcomes. This gives you the ability to move past mere summarization in your reports and research to pure plan analysis executed on demand by your systems.

However, to get to that productive state of reporting, you’ll need to first update your data collection, management, and governance processes. Without such a backbone, even the best AI algorithms will fall short.

Enriched operational insights

Getting your back office in order is the first step toward hitting a higher plateau of productivity — that is, powering up your operations with both internal and external insights.

Your internal data provides you with only a partial view of your customers. You can only tell what they’re up to when they’re engaging with your products and advisors. In essence, you know what they think it’s important for you to know. But we humans aren’t always rational. Sometimes we want others to guess what we actually want without saying it.

To reach the coveted 360-degree view, wealth management companies need to cast a wider net that will also capture the following data:

- Social media sentiment to estimate general market trends for investing advice, plus to collect customers’ sentiment around the brand

- Crowdsourced economic, demographic, and social data to pin specific microeconomic and macroeconomic trends to specific customer needs, pains, and behaviors

- Alternative financial data from other FinTech, TechFin, and financial players to better understand a customer’s credit standing, spending, and savings habits within an ecosystem of products they’re using

An effective concoction of internal and external data sources can open up a brand-new level of quality for operational insights to guide your sales, marketing, risk, and portfolio management strategies.

Supplying your proprietary AI algorithms with a wider array of data points will allow you to effectively tell where your customers stand right now, where they want to be during their next life stage, and what you can do to help them get there.

To conclude

As many as 80% of wealth management clients remain on the sidelines of receiving relevant financial advice. AI and ML are your strongest bets to reach them with the right advice at the right time.

Getting proactive with your outreach, onboarding, and advising is the optimal cure to addressing switching behaviors. After all, you don’t walk away that easy from someone who anticipates your unique needs and knows exactly how to meet them.

Contact Intellias to talk about viable AI use cases in wealth management and ways to incorporate new tech into your operations.