Until recently, end-to-end encryption was the best defense for security in payment transactions. Designed to scramble user’s credit card details, personal identification and account numbers while purchasing goods, it’s a means of conforming to EMV standards to protect against credit card fraud. Though highly effective in most cases, the system is open to vulnerabilities. Several high-profile data breaches have been widely publicized, which have driven new security measures to take place.

Payment tokenization accelerates the provision of secure transactions. Data security is of highest importance as consumer adoption of alternative payments such as card-not-present (CNP) and mobile payments grow. Implementing tokenization can be a seamless process, as there is little impact on issuer’s back-end technology, and for merchants, no new hardware or software is needed. This added layer of security complements end-to-end encryption and creates a digital fortress to deter hackers.

What is payment tokenization?

Payment tokenization is a highly secure method of protecting financial data, such as credit card and bank details while performing transactions.

Instead of sending sensitive data from a customer’s credit card for online, mobile or contactless purchases, the details are replaced by a randomly generated alphanumerical “token”. This can be between 13 and 19 characters long that omits the primary account number (PAN), or any other details that could lead to the identification of the customer.

Each token is unique for every transaction and cannot be replicated in any other store, for any other purchase.

Using a payment tokenization solution, ensures all payment data stored for processing by merchants are rendered useless for hackers. Devastating payment data breaches such as the Heartland security breach, cannot affect consumers, as their sensitive data is never stored on the servers in the first place.

How does payment tokenization work?

Unlike EMV protection, which employs end-to-end encryption, a tokenization payment algorithm ensures the cardholder information is never transmitted or can be accessed by hackers.

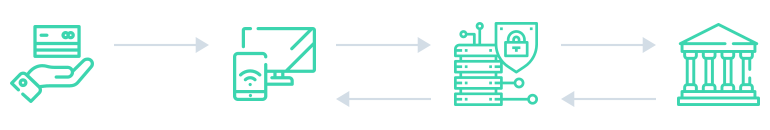

Tokenization processing for online or mobile payments:

- Customers enter their name and credit card details.

- A payment token is requested from the payment service provider.

- Token request is shared with the customers bank or account issuer.

- Once approved, customers PAN is replaced with a “token”.

- The token is then used to complete the purchase.

Where are payment tokenization systems used?

Tokenization is increasing in popularity due to enhanced security measures. Payment providers are quickly catching onto the trend, using the framework in place to provide their own secure methods of payments.

Mobile payment providers like Apple Pay or Google Wallet, strive to ensure cashless transactions are effortless. By taking a picture of your credit card or inputting your card details to your mobile wallet, you can instantly make purchases with your phone in stores that accept contactless payments. In both cases, a token is produced in lieu of your credit card details, so no unencrypted data is ever stored on your device.

Credit card providers are using tokenization in the payment card industry. This gives an extra layer of security along with traditional methods of encryption. It guarantees even if servers are hacked, no raw credit card data is available to be misused.

E-commerce stores have implemented tokenization for online purchases. Online merchants use payment gateway providers, such as Paypal or Stripe, to process credit card details. If merchant’s data servers are ever compromised, critical information remains safe as only token details are kept.

How payment tokenization security has revolutionized the way we pay

The success of tokenization in payment security, has influenced new ways of purchasing. Now there’s no restriction on the many outlets of payment opportunities, as security has been vamped up. We’re now at a stage where:

- Contactless payments,

- Mobile payments,

- Online payments,

- Wearable device payments,

Are all just as safe, if not more secure than regular cash or chip and pin transactions.

Globally, PCI DSS (Payment Card Industry Data Security Standard) has been established for merchants that accept payments from any of the major card schemes, such as Visa or Mastercard. Created to reduce credit card fraud and keep card data safe, end-to-end encryption is mandatory to comply with these standards. Introducing tokenization to your payment system, eases compliancy with these standards and boosts security issues by never handling any financial information that can be used for malicious purposes. The security features of tokenization are so important that the PCI DSS standards are aiming to introduce mandatory tokenization in future guidelines.

Benefits of tokenization in payment processing

Opportunities and benefits from tokenization add up when it comes to fostering great relationships with your customers. Not only does it keep data from payment processing secure, but it:

- Creates trust with your customers

- Reduces risks from data breaches

- Protects more than just credit card details

- Is compatible with new technologies

Customer trust

Customers only purchase when they know their details are safe. With tokenization, credit card details are never disclosed, whether online or in-person. Recurring payments can easily be set up in this environment, keeping data secure and ensuring a trustful relationship is maintained between your business and customers.

Reduces risks from data breaches

A lot more goes into protecting your servers from data breaches than tokenization. But, implementing this step ensures if your servers are hacked, none of your customer’s information can be used for fraudulent purposes.

Protects more than credit card details

Tokenization enhances security for a variety of purposes. Including credit card details, user names, passwords and personal identity, just to name a few.

Compatible with new technologies

Innovative payment solutions are being introduced every day. Near-field communication (NFC) devices allow payment data to be securely transmitted through alternative devices like watches, jewellery, mobile phones and even coffee cups.

Tokenization as a payment solution

Tokenization has created a foundation for new payment technologies to build on. Providing a fast, convenient and secure payment experience, ensures data is protected and allows trust between merchants and consumers to thrive. Momentum is growing for innovative payment solutions, with security being the number one priority. The framework in place presents unprecedented opportunities for the financial industry.

As tokenization becomes mandatory for payment processing, it’s high time to disrupt the payment industry. Contact Intellias to develop a payment tokenization system for your business with enhanced cybersecurity consulting service.