Every business deals with money, but few retain ownership of consumers’ financial experiences. Traditionally, banks and payment facilitators were the ones to handle all the money matters: setting transaction fees, deciding on lending terms, issuing cards. Until they were removed from this pedestal by embedded finance and financial services from tech companies.

What is embedded finance?

Embedded finance is a technological approach to incorporating financial products (like lending or insurance) into another type of product at the customer’s point of need.

Think of embedded finance and financial services as a savvy upsell, contextually prompted by your brand when your customer needs it most; for example, offering buy now pay later (BNPL) financing at checkout, or allowing customers to pay for fuel straight from the car dashboard.

Right, but isn’t that payment integration? Yes and no. Unlike standard integrations, embedded systems in finance ensure continuity in the customer experience (CX). There are no redirects to a standalone checkout page hosted by a third-party payment provider or extra account sign-up steps.

But more importantly, embedded financial technologies allow you to retain full control over the customer experience, customer data, and ultimately profits. Your financial offering can be fully on-brand: closely aligned with your other products and services and managed in the same way.

Settling a bill, ordering delivery, paying for parking — many of our money-related actions are streamlined thanks to frontend transformations in digital banking.

But many other issues keep needling us. Think about small frustrations like forgetting your card when walking into a store or eying up a vending machine that only accepts coins (which of course you don’t have). These are minor things that derail us from making a purchase.

At the same time, bigger annoyances deter consumers from buying: lack of straightforward financing for a big-ticket item like a car, or the need to open a business banking account in person to join a new freelance platform. Such things delay or dissuade a possible sale.

Embedded finance can meaningfully improve the customer experience and unlock a huge market opportunity, with an estimated $230 billion in net new revenue by 2025.

Embedded finance gives brands an opportunity to overcome objections, annoyances, and hindrances preventing consumers from buying. By embedding a financial offering into your core product, you can remove another cognitive chasm on the customer journey and make it easier for customers to transact with you.

That’s exactly what modern connected consumers want — seamless, contextual access to the right offers at the right time.

What makes embedded finance and financial services a promising avenue for revenue diversification?

To better understand the value behind embedded finance business models, let’s look to another FinTech trend — open banking.

Open banking is a regulatory and technology movement promoting the sharing of customer transaction data with any third party. This has enabled two shifts in the financial sector:

- Aggregation. FinTechs and financial institutions (FIs) are empowered to securely exchange data with one another — and provide consumers with a more consolidated view of their finances.

- Collaboration. Apart from merely exchanging data, financial players have decided to join up to provide a wider set of products to customers — and they are also inviting non-financial players to their ecosystem.

Open banking has also served as a springboard for a new B2B offering — banking as a service (BaaS).

BaaS allows FinTech and non-financial companies to offer a host of embedded banking services to their customers, from full-featured current/checking accounts and credit cards to savings and investment products.

The allure of BaaS is that companies on the receiving end don’t have to hold a banking license and deal with compliance matters. That’s what the BaaS license provider — a regulated financial institution — does for you.

Embedded finance in the financial sector is auxiliary to BaaS.

Some offerings originate from financial institutions (Solaris Bank) and FinTechs (Plaid). Others come from tech companies like Stripe or Klarna. In every case, those embedding the technology don’t have to worry about financial industry regulations and compliance. That’s taken care of on the supply side.

In the same way that cloud computing services democratized the ability to launch software products, embedded finance makes it possible for any brand to dabble in financial services.

Some 70% of brands surveyed by OpenPayd plan to incorporate embedded financial services in 2022 and 2023. Accenture predicts that by 2025, SMEs could get a revenue uplift of up to $92 billion from embedded finance.

At the same time, funding for embedded FinTech companies has increased threefold between 2020 and 2021, currently sitting at $3.1 billion annually.

Why all the (gold) rush?

Because financial services and embedded finance are relatively easy to incorporate into existing products and generate sizable benefits for brands.

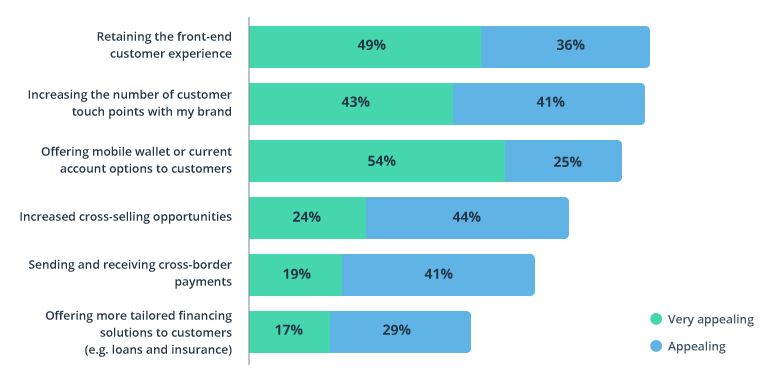

Appeal of embedded finance offering

Source: OpenPayd — Embedded Finance Research Report

Combined, the above advantages enable non-financial companies to secure higher profit margins and diversify revenue.

Ecommerce retailers run on razor-thin profit margins, constantly undercut by growing customer acquisition costs (CAC). Providing finance to customers allows retailers to add an extra revenue stream without charging customers more — and allows them to convert more prospects.

Embedded finance also enables non-tech companies to tap into economies of scale; that is, to grow more profitable with the help of ecosystem partners.

Take it from Google. Originally a search engine, Google now has its hands in many different profit pools, from advertising and cloud computing to finance. Google Pay is a prime example of an embedded payment solution used by millions of consumers and businesses. Google also lets users send money (in some markets) and offers 0% APR financing for Google devices to UK consumers. Does that make Google a financial company? No (though they aspire to be).

Google is leveraging an existing product ecosystem, customer knowledge, and strategic tech partnerships to expand their reach. And that’s the power of platform businesses and the ecosystems they create.

Embedded finance, in turn, enables brands from other industries to join an existing ecosystem (or form an ecosystem of their own) and use the power of many to grow more profitable. As an online retailer, you can use proprietary data such as customer lifetime value or return rates to build custom risk profiles for personalized lending offerings. This can produce better margins on embedded financial products and spur new embedded value financing options.

The transition to ecosystem operations ultimately results in:

- Lower product/service development costs

- Faster expansion to new markets

- Horizontal product portfolio growth at high speed

- Lower customer acquisition costs

- Higher customer retention and loyalty

Growth-oriented embedded finance use cases to explore

Between now and 2029, the embedded finance market is set to grow at 39.4% annually.

Some analysts go as far as to say that the embedded finance and financial services market will exceed $7 trillion in the next decade. A more moderate forecast sets the number at $136 billion by 2026.

No matter which number we land at, the growth is already massive. And much of it comes from the systemic transition to ecosystem operations.

Take it from Shopify. Once a simple ecommerce store builder, the company grew to a $100 billion valuation via strategic investment in embedded business finance offerings. First, they resold integrated payment products from Stripe. Then they launched an embedded payment processor — Shopify Pay — to monetize via transaction fees.

As their data sets on merchants expanded, the company moved into embedded lending. Eligible retailers can easily apply for personalized loans in several quick steps. The accumulated data, in turn, lets Shopify make fast, accurate, and risk-free underwriting decisions.

Non-tech companies too are gearing up for the race. Walmart has teamed up with Ribbit Capital to co-invest in a new FinTech platform that it plans to put at the heart of its operations. The revealed project details suggest that this will be a singular platform, enabling consumers to spend, save, and borrow money with the help of Walmart. Additionally, Walmart employees will be able to use the platform for budgeting and savings.

Clearly, big things are bound to happen in the embedded finance space. And opportunities are ample for many players, as the following use cases illustrate.

Embedded payments

Payment processing is often the first financial layer companies embed into their products. Stripe and Plaid built a new business out of offering embedded payment options.

We also have non-financial players who have turned into payment facilitators — those performing underwriting, onboarding, compliance, and reporting for their customers, typically with the help of other software providers.

That’s the case with Shopify, BigCommerce, and Square. All offer online payment processing solutions that complement other core offerings.

Square first specialized in POS payment processing. In 2013, they expanded into online payments, simultaneously launching a simple online store builder. By 2020, software and integrated payments represented two-thirds of the company’s gross profits. Square Invoice alone generated over $100 million that year.

IoT payments

IoT payments — machine-triggered device-to-device transactions — are another promising use case of embedded finance in FinTech. Many of our devices have gotten extra wits and are now capable of processing payments on the edge (on the device).

In-dashboard payments for fuel, parking, and commercial services are worth $3.2 billion globally. Self-service and unattended retail solutions have grown more popular with consumers post-pandemic. Likewise, servitization in the manufacturing sector breeds new use cases for IoT payments.

Smart devices, however, come with new tech specs, often rendering traditional approaches to payment integrations ineffective. The form factor itself also requires new UX approaches. That’s why embedding financial services often makes more sense.

For example, as a manufacturer, you can access a new revenue stream by:

- Offering payment plans for smart device purchases

- Embedding insurance products into more expensive models

Retailers, in turn, can speed up the physical checkout experience with self-service cash desks that can identify existing customers with their credentials and then:

- Automatically bill their account-connected payment method

- Offer personalized financing plans or BNPL offers

Automotive manufacturers, in turn, can draw extra revenue from in-car payments for services, products, and insurance.

Embedded insurance

The insurance sector is looking for new ways to infuse resilience and innovation into its operations. Technologies, understandably, play a key role in insurance industry transformations.

API-driven IT architecture and advanced process automation has enabled insurers to aggregate, process, and operationalize data at warp speed. Some are now looking for ways to rent out their services to other businesses, from airlines and automotive companies to manufacturers and retailers. Insurers offering APIs can establish new partnerships with third parties in 6.9 months on average.

Companies in many markets can profit from such partnerships:

Source: Dealroom — Embedded insurance ready to take off

For instance, Cowboy (a connected e-bike retailer) has partnered with embedded insurance provider Qower to offer insurance products straight to consumers. Cowboy launched two insurance packages customized for their riders and seamlessly integrated them into their user app. Now over half of Qower shoppers add digital insurance to their cart at checkout.

Embedded lending

Buy now, pay later (BNPL) covered 6% of all digital transactions in 2021 and is projected to reach 13% coverage by 2025. The reason for such a spike in popularity? BNPL products are easy to embed, making them a low-effort, high-value revenue diversification opportunity.

But embedded lending is bigger than BNPL. Retailers and manufacturers can also effortlessly extend other forms of consumer credit digitally, from auto loans to branded credit cards.

Then there’s the separate field of business lending, actively cultivated by tech companies with embedded financial offerings like Shopify, Square, PayPal, Amazon, eBay, and Stripe.

Yet another type of embedded finance from tech companies is payroll advances. For example, digital banking provider Claire specializes in providing on-demand pay to employees. They exclusively sell their product as an embedded offering to HR, payroll management, and workforce management software companies.

Marketplace offerings

Finally, why should you settle for one embedded finance product when you can curate several? Technologically, that’s feasible.

In fact, that’s what many digital banks successfully do — offer access to a marketplace of financial products supplied by partners. Some offers are fully embedded, while others are integrated. In both cases, however, companies get to fulfill a wider spectrum of consumer needs and improve retention rates while pulling in extra profits.

Take a lesson from Uber. Their Uber Money includes:

- A no-monthly-fee Uber debit account supplied by Green Dot bank

- A free Uber debit card with cashback, also from Green Dot

- An Uber credit card delivered by Barclays

All of these are neatly integrated into the Uber Driver app. Internationally, the ride-hailing company also partners with other embedded financial services providers like BBVA (to provide digital banking accounts to drivers in Mexico) and Paymob in Egypt.

Getting Started with Embedded Finance

The financial sector is morphing from an invite-only club to a buzzing LinkedIn community, welcoming non-financial players. Underlying changes in IT architecture — cloud computing, microservices, and APIs — have made that possible.

To join the party, you need to concentrate on your API strategy — a roadmap for technologically connecting different applications (owned, integrated, and embedded) to create new types of continuous customer experiences.

Remember: embedded finance is about more than just a better customer experience. When deployed effectively, it’s your means to enter the vast and lucrative world of financial ecosystems sans the regulatory red tape.

Contact Intellias to discuss your go-to strategy for adopting embedded financial solutions as a non-financial company.