Once upon a time, banks were the only way to make payments. But with the arrival of FinTech, things have changed. We now have multiple apps for settling all sorts of financial affairs straight from our phones and laptops.

The variety of choice may be an awesome thing. But it also creates decision fatigue. The average user has 80 (!!!) apps installed on their phone but uses just 40 of them each month.

So do we really need yet another app, especially when it comes to finances?

Or do we need a Super App to rule them all?

What’s a Super App?

A Super App is a product that combines a bunch of services and allows third-party developers to integrate mini programs inside the main product.

If you want a deeper take on Super Apps, Kenta Nagamine has published a great piece on Medium going into all the nitty-gritty.

So I’ll just throw out a quick example: think about iMessage, with all those add-ons you can install such as instant translation, ETA, and tons of funny stickers. You can also connect Apple Pay Cash and send Venmo-style payment requests to your friends.

Now picture this: instead of merely sending cash back and forth to your contacts, you can actually book and pay for a doctor’s appointment, ask for a small loan, or book a hotel without reaching for your card.

If you’re in China, you can already do that with WeChat.

The case of WeChat

WeChat’s average revenue per user (ARPU) is estimated to be at least $7 — that’s 7 times the ARPU of WhatsApp, the largest messaging platform in the world.

WeChat was launched in 2011, primarily as a messaging app for sending text and voice updates and pics to friends and family.

Back then, China had really low email penetration rates. Texting and voice plans were expensive, while SMS spam prevailed. Tencent, WeChat’s parent company, already ran a popular web messaging platform called QQ. But then smartphones started taking off. By 2015, 90% of Chinese internet users were browsing the web on mobile.

And here’s another thing about China — the credit card penetration rate was rather low.

Local society was running on cash. To a large extent, it still does, as China has the world’s biggest unbanked population — 225 million live without access to traditional banking services.

But do those people really need a traditional credit/debit card when they have a WeChat wallet?

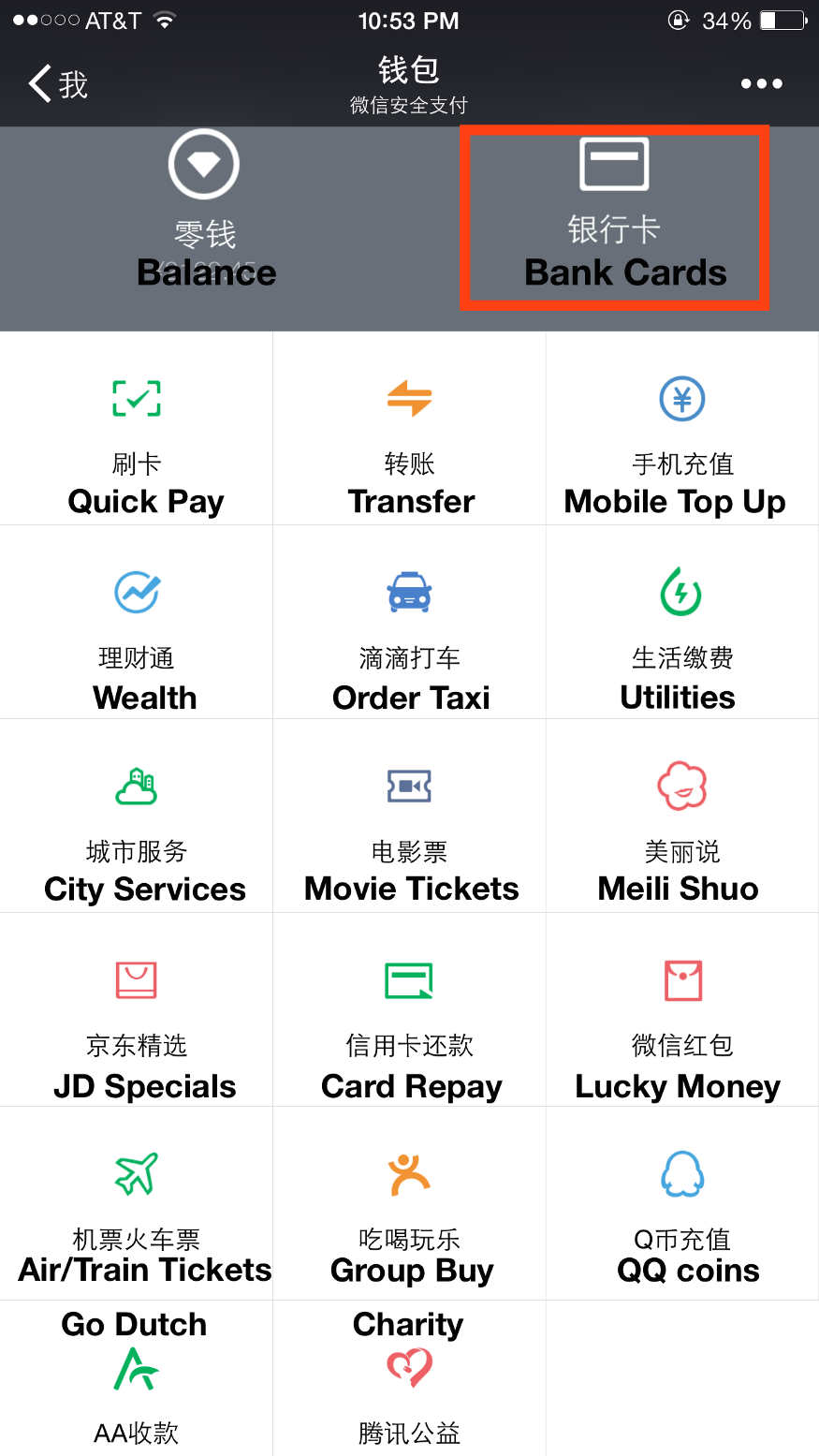

The WeChat payment service allows you to pay for goods and services online and in-store. At a brick-and-mortar location, all you need to do is scan your barcode to pay. Shopping online is even easier. You just connect with a merchant inside the app and pay in a few taps.

However, the WeChat “wallet” is not a traditional mobile wallet per se. It’s a marketplace with carefully curated, pre-approved service providers that users can transact with — taxis, doctors, government services, and even celebrities. When spending money is as simple as a few taps, usage stats skyrocket.

In 2017, China’s mobile payments reached over $5.5 trillion, roughly 50 times the size of the US market.

And here’s another important thing about WeChat.

Its ecosystem, now populated with 1 million “mini apps,” was not 100% homemade. Most of the cool features and services within WeChat are deployed by third-party developers — companies who rushed to get a slice of WeChat’s user base. Those mini apps offer a seamless experience with other businesses (e.g. an e-commerce company) while never asking the user to leave WeChat’s ecosystem.

As well, such programs are cheaper and easier to develop than native apps. They often become an ideal MVP solution for startups and services that lack substantial reach.

Finally, consumers are offered a smooth and secure payment experience, with automatic authentication of identity and payments as well as careful vendor vetting. So no wonder Chinese consumers are spending big time on WeChat.

But can a similar Super App model settle down in the West?

Facebook’s Libra + Calibra: Taking a page from WeChat’s book

Rumors that Facebook was looking for a way into the payments market have been circulating since 2014.

But with all the bad data privacy rap and anti-monopoly sentiment among global legislators, Facebook obviously knew that treading the traditional regulatory waters would be tough. Getting a charter or banking license would be nearly impossible. From that standpoint, the blockchain seemed like an obvious choice.

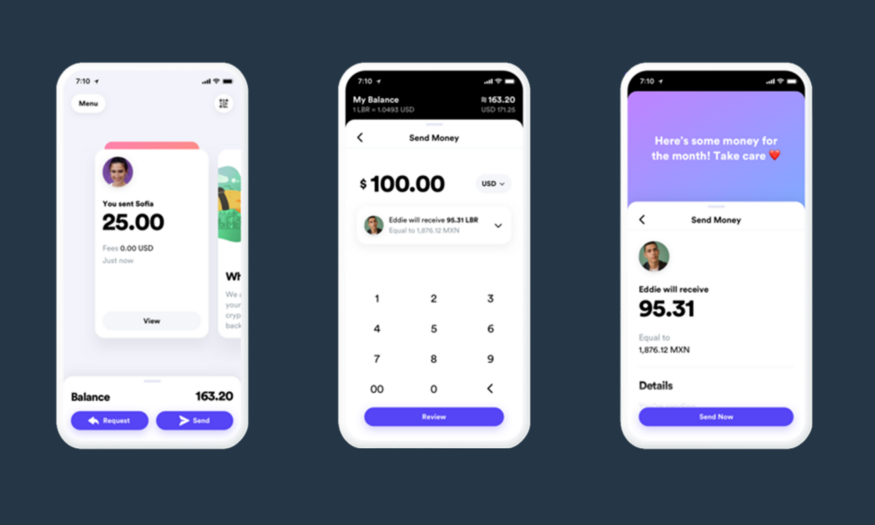

So now we’re facing Calibra — the company’s shining new digital cryptocurrency wallet to pair with the platform’s Libra cryptocurrency.

As explained so far, Calibra will be aimed at doing two things:

- Storing your money for free

- Enabling quick transactions at low cost via Facebook Messenger and WhatsApp (and probably other Facebook products later on)

Source: Facebook

Just like WeChat, this mobile payment app starts with a huge competitive advantage — seamless integration with a platform boasting 2.7 billion users.

Plus, Calibra already has a lot of high-profile backers who are very much thrilled with such a lavish opportunity:

Clearly, all these early supporters can benefit big time from a Facebook-integrated payment experience.

FarFetch, the leading luxury retailer, could create a whole new purchasing experience where users click shoppable Instagram posts and can check out in one tap.

Spotify sees this as an opportunity to penetrate new markets:

One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems — especially for those in financially underserved markets. In joining the Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.

Visa, Mastercard, PayPal, and Stripe also plan to get a slice of all those new in-platform transactions spanning Facebook, Messenger, WhatsApp, and likely Instagram.

And Facebook themselves have communicated their agenda rather clearly:

We hope to offer additional services for people and businesses, such as paying bills with the push of a button, buying a cup of coffee with the scan of a code, or riding your local public transit without needing to carry cash or a metro pass.

All this while getting a good cut from those transactions and increasing the average revenue per user well above the current $7.37 globally, as well as pumping up the stagnating daily time spent in the Facebook app.

At this point, the only difference between WeChat and Facebook is that the first is actively backed by the Chinese government, while the latter has decided to bank on new tech instead.

How digital banks and other FinTech companies can move from a “banking solution” to a “financial platform”

I’ve mentioned WeChat first and Facebook second for a reason. Both social media giants show what it’s like to be both a platform and a financial services provider.

In both cases, the companies’ competitive advantages are:

- A gigantic user base

- Access to incredible volumes of customer data

- Seamless ability to “connect the dots” — pitch a service that a lot of users want and can effortlessly use

- Marketplace-capabilities — AKA inviting third parties into their ecosystem

But the tech giants are missing one key element: unlike Chinese consumers, most of us still prefer to use our beloved credit/debit cards or good old cash instead of mobile payments.

WeChat was able to leapfrog credit cards and go straight to mobile payments. But Facebook is unlikely to pull the same trick on a global scale.

And that’s where digital banks maintain a competitive edge.

All they need to learn is how to leverage their financial core and match it to the platform approach. Below are several tips for doing that.

Consider the BASIC technology strategy

Ant Financial (formerly Alipay), another Super App from China now valued at $150 billion, says that their success is built on five pillar technologies:

- Blockchain

- Artificial intelligence

- Security

- IoT

- Cloud computing

Using those interchangeably (and as a happy combo) allowed Ant Financial to move beyond a mobile payment app to a comprehensive financial platform offering consumer and business loans, wealth management services, credit scoring, insurance, and biometric ID services.

The best part? They piggybacked on their existing user base to test out new features and seamlessly onboard new users post-release.

In a whitepaper I co-authored, we discuss how digital banks can leverage that new tech stack and what features they should implement to capture new target demographics.

Seamless KYC and onboarding

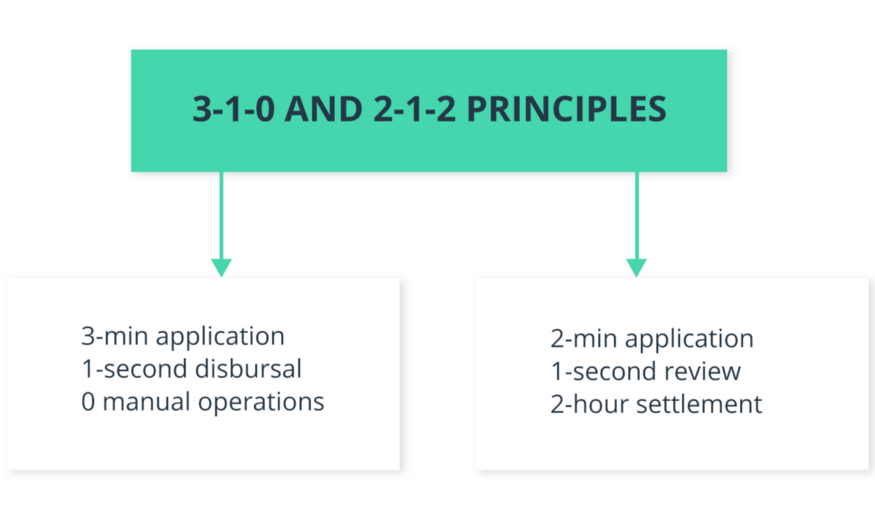

Here’s another lesson worth borrowing from Ant Financial: the 3–1–0 and 2–1–2 principles.

For micro-loans, Ant Financial designed a 3-minute application process (most KYC data gets automatically pulled from the customer’s all-in-one profile), 1-second disbursal, and 0 manual back-office operations (those were effectively replaced by machine learning and predictive analytics).

MyBank uses big data on repayments from Alipay, which has over 600 million users, and other financial services of Alibaba to assess monthly sales of small businesses and their repayment patterns.

In a similar fashion, they have a 2-minute application for loans, 1-second auto-review, and 2-hour settlement done algorithmically.

This may seem like supersonic speed, but as a digital bank, you already have leverage:

- Your customers’ entire spending/banking history can be parsed and analyzed for decision-making.

- New technologies (e.g. predictive risk modeling, blockchain) can minimize the human involvement in the process, reduce risks, and grant approvals with less bias.

And the ball is in your court after all.

Forge partnerships

Ant Financial chose to build up their services stack in-house. WeChat and Facebook are choosing the partnership route instead. They’re strategically onboarding new service providers to populate their ecosystem and provide mini apps within their Super App.

Selecting and negotiating with the most suitable business partners will be crucial to scaling your product. Partnering with experienced tech developers who already have deep experience in the domain and can guide you towards better tech and API/integration decisions.

The future of banking is a platform

At this point, it’s hard to tell whether Facebook will become WeChat and get a major share of the mobile/online payment market in the US and beyond.

But one thing is certain: they’re banking on the platformization trend.

Other FinTech players should be looking in the same direction if they want to succeed.

To stand against a mammoth-sized competitor like Facebook, you need to build a technological ecosystem that can seamlessly accommodate the addition of new valuable services for end clients… without having them leave your app.