Are AI banking chatbots a necessity for a high-performing bank? Find out more why you should set up chatbots for yours.

Do you think customers enjoy communicating with their bank, or that they would rather have more time in their day? By introducing AI chatbots for banking you can significantly improve communication with your customers. No queues, no multi-page agreements, no stress… just imagine how happy your customers will be, as chatbots for banks are perfect for maintaining a happy and loyal consumer base.

Amongst the key technological trends these days, AI chatbots in banking have entered the highly conservative financial industry and the message is clear; they’re popular and here to stay. That’s because customer satisfaction remains a top priority for banks, just like for shops and other online services. When people want high quality services, businesses provide; if they don’t, businesses trail far behind.

Chatbots in the banking industry represent one of the most important technological changes it’s experienced to date, and have provided many benefits. Artificial intelligence in banking is here to stay, and AI based chatbot services are essential to making a success of this technology.

What is a banking chatbot?

Banking chatbots carry out a variety of specialized tasks by generating conversations that sound more natural and can be used in thousands of interactions simultaneously. They can significantly improve the user experience by using AI and machine learning to leverage natural language processing (NLP) and provide customer support 24/7, making it easy for customers to access the banking services they need, whenever they need it.

AI chatbots in banking are perfect for allowing your bank to streamline antiquated processes, provide updates and notifications without human input, create detailed customer profiles, and enable more interactive conversations between customers and their banks. They also ensure that your customer support team has significantly more time to focus on more complex issues, rather than having to deal with routine customer interactions.

Why are banking chatbots important?

Changing demographics

AI chatbots in banking are important due to changes in the customer base of most banks.

Millennials and Generation Z have an entirely different way of thinking than baby boomers. They chat, travel, manage their businesses online, multi-task, and rely on their smartphones, meaning that AI chatbots in banking is something they can readily adopt and integrate into their lives.

These modern generations can’t use a slow chat with a bank representative in an office to review their monthly expenses, renew a card, or sign a new agreement. Quick and precise problem-solving on-the-go is why they use AI chatbots. They expect financial services to benefit them beyond securing their money, and they demand the high-quality customer service AI chatbots in banking can offer.

How AI is being integrated into the Banking Industry

Audience identification

AI chatbots in banking are a way for businesses to reach out to new, agile audiences and set up ongoing and meaningful conversations with them in general. However, it begs the question, can banks get advantages out of chatbots specifically? Absolutely, and AI chatbots in banking can help you find the new audiences you need to grow sustainably.

Is it worth the effort of finding an experienced vendor, building a complex fintech solution powered by AI, and reshaping your entire business process that has been tried and tested over many years? Spoiler alert: Yes, AI chatbots in banking are worth it, and Intellias has the expertise to prove it.

Five benefits of chatbots for banks and financial services

Every bank strives to optimize their processes while providing high-quality service. The use of AI chatbots in banking helps companies achieve these goals. They can easily deal with vast volumes of data and answer customers’ questions instantly.

Here are the key reasons why banks should consider creating AI-based chatbots, both for their clients and for their internal operations. Study these examples to understand how banking AI chatbots could benefit you.

Personalized banking services

AI chatbots serve as virtual financial advisors, helping users get exactly what they need. Bank customers can ask questions and generate replies in a couple of seconds. That means there’s no need to call the bank or browse one’s card history to find out how much you spent on restaurants last month.

A customer may ask for advice on better budgeting, the most convenient savings plan available, deposit options, and so on, and the chatbot will offer relevant financial products, since it knows the background of each particular customer. This makes the customer experience more streamlined.

With chatbots for banks, employees can effectively use and process information about their clients: what type of card they use, how often they use it, what they buy and where they buy it, when they pay their credit card bills, and so on. The ways of leveraging this information are endless, and it takes an AI-powered chatbot to process it.

Round-the-clock customer support

Round-the-clock customer support is the most obvious reason to use chatbots as a bank. They answer anytime, regardless of working hours and traffic peaks, exactly when the customer needs an answer. AI chatbots in banking don’t need to take vacations or sick days either.

If you have a problem with an ATM while visiting a foreign country, a chatbot can help you solve it in a matter of minutes instead of going through the complex process and waiting times of a call center. When you need to increase your card limit to buy plane tickets that are on sale, a chatbot can do it instantly. What if by the time you finish your phone call with the bank, the tickets are gone, or have significantly increased in price?

AI chatbots can deal with 80% of customers’ requests. You still need human support to help with the most complex 20% of tasks, but the cost efficiency is tremendous. They’re an excellent tool with very little downsides or negatives.

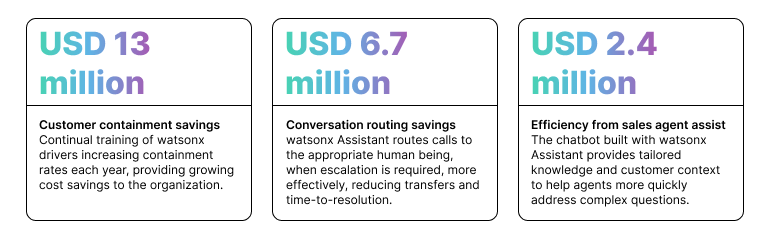

Potential annual US salary savings created by chatbots

Source: IBM watsonx case study report

Surprisingly enough, a call center employee may sound more robotic than a chatbot. While people are taught to answer questions using set phrases, chatbots can generate lively conversations and still be professional. Once you leave answering the commonly repeated questions to computers, your valuable bank employees can deal with more complicated requests.

Improved marketing strategies

Customer satisfaction is crucial for achieving success in the banking industry. Knowing who your target audience is and what they want are the key elements of achieving this success.

There are more benefits of using AI chatbots in banking to achieve higher customer satisfaction. Modern payment providers and fintech companies offer a variety of products and services, but how do you know if, say, Mr. Lee could use a savings plan, and Ms. Daniels would like to invest?

It would be hard for bank employees to figure this out on their own since it would require digging through a large volume of information and performing in-depth analysis. However a chatbot can solve the riddle in seconds.

Certain questions or actions can lead a chatbot to conclusions that people may not arrive at. The next step the chatbot can then take is offering a specific banking product or service that will lead Mr. Lee and Ms. Daniels to a new purchase.

Companies can gather feedback and promote new products without frustrating customers by using AI chatbots in banking. AI takes user analytics to a whole new level: chatbots help to produce valuable, real-time, and insightful reports that can be used to improve services and strategies.

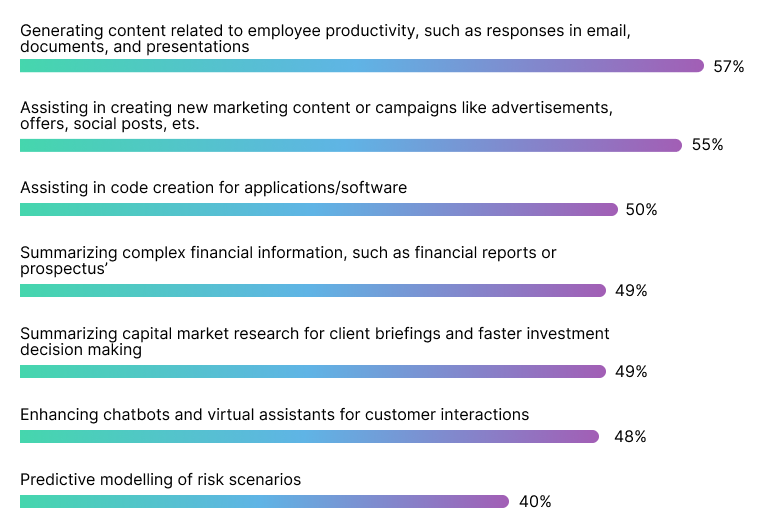

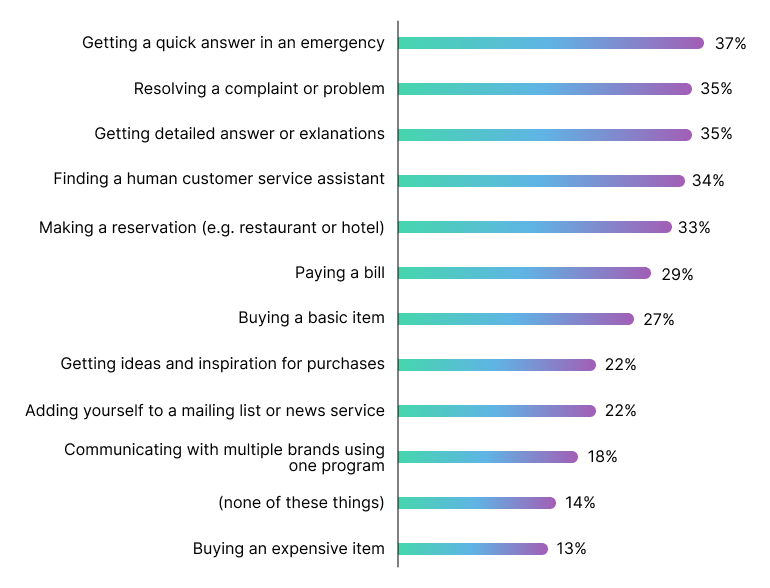

Predicted use cases for chatbots

Better Security

Strict personal data protection and multi-level validation procedures are amongst the key challenges in the banking industry today. Tight regulations and licensing are among the top reasons why the field is so conservative. Along with the rise of cybercrime, some consumers have registered protests about the use of AI chatbots in banking because of security concerns.

The answers to these concerns are fingerprint authentication, facial recognition, and encrypted conversations. As such, consumers do not need to be concerned as AI chatbots in banking are thus more secure than phone calls or live communication with a bank representative.

Besides, chatbots are actually helpful in fraud detection. That’s because they can find out in seconds whether a user has made a suspicious transaction and react appropriately by blocking the card and reporting the breach.

Easy payment processing

The total revenue of the global chatbot market last year reached $137.6 million and is expected to reach half a billion in five years, and there’s a good reason why. People don’t have to leave a comfy and familiar app to make a payment. All their cards and accounts are available to their fintech chatbots, allowing users to make purchases and transactions without leaving their social media pages.

Let’s take Facebook as an example: it’s full of products and services people can buy and order. Payments via financial chatbots are nearly instantaneous, so users don’t have a lot of time to reconsider purchases. This means frequent purchases, a constant flow of transaction fees, and more products and services that banks can offer to customers.

The drawbacks of banking chatbots

Can’t provide real empathy

Nothing is perfect and chatbots do have some drawbacks that are worth noting, starting with the obvious in that they are not able to fully replicate human emotions. They can approximate them, which makes them ideal for routine interactions, but they can neither provide nor relate to empathy. This makes them unsuitable for handling distraught customers, so make sure you have a hybrid system to allow humans to deal with humans in extreme cases.

High set up cost

AI chatbots in banking an be costly to set up and maintain as well, especially if your company is relying on outdated legacy systems. The initial cost can be off-putting for many financial institutions, particularly those of a smaller scale or who cater to niche markets.

It’s also not a good idea to scrimp on money and use low-quality chatbots as they will prove very off-putting to your customers. Despite the initial cost, it’s worth every penny.

Cyberattack concerns

Cybersecurity concerns are a legitimate issue to consider too, as hackers can use generative AI to fool chatbots into revealing secure information. If you do decide to use chatbots, you have to ensure you can provide the best quality security and data protection to your clients. This is something the Intellias team has considerable experience with.

The key features of good banking chatbots

When looking to integrate a AI chatbot at your bank you should consider the following factors as they’re indicative of a high-quality service. Remember, it’s important not to skimp on choosing a low-budget offering, you should invest in something that will last a long time.

- Conversation – A good chatbot has to be able to provide conversation that mimics real speech patterns. This provides a personalized experience that incentivizes the user to keep using your bank’s services. If it’s too robotic, it’ll have the opposite effect.

- Privacy – As mentioned above, you have to ensure the utmost privacy and security for the conversations that are created by AI chatbots in banking. Failure to do so leaves you at risk of data breaches, cyberattacks, and resulting lawsuits.

- Transactional – It’s one thing to have a chatbot that provides good conversation, but it has to be for a purpose. Good systems are transactional, being able to provide services rapidly and with accuracy.

- Multi-device – Banking customers want to access their accounts on their terms at their convenience. If your chatbots only work on phones or PCs for example, they won’t be successful; you have to offer the chatbots across multiple devices as standard.

The process of implementing chatbots at your bank

The primary goal of AI chatbots in banking is to help people with routine banking issues that human employees frequently get bogged down by. To do this, you can integrate a robust AI solution with Facebook Messenger, Telegram, Skype, and other popular messengers and apps, to create a system that benefits everyone.

These messaging platforms can recognize and seamlessly interpret language and provide the same experience on mobile and the web. Your AI chatbot for banking will need to be regularly upgraded on new services that are available, and it will inform customers about new features and extended possibilities that it offers automatically.

Creating and implementing chatbots in the banking industry starts with finding the right vendor. Working with a vendor, you’ll define the key goals for the chatbot, analyze the ROI from its deployment, create user personas, and more. Companies like Intellias that have experience in building AI-based solutions for fintech will be your best pick. That’s because they’ve worked with banking industry leaders to create conversational AI for their institutions, along with other forms of financial bots.

We’ve helped banks develop AI-based chatbot services designed specifically for niche audiences and international groups, and made sure that fintech bots get set up for a wide range of banks. To find out more you should send us a message today via our contact form where you’ll be able to learn about banking chatbots and other issues.

Final Thoughts

Using AI chatbots in banking is the best way for your bank or financial institution to reach new customers and maintain the base you currently enjoy. Your customers will benefit from increased personalization and services, and your employees will have more time to spend on essential issues. It’s a situation where everyone is a winner.

Don’t hesitate if your bank is considering adopting this technology; contact Intellias today! You can find out more about how we can support you with the adoption, adaptation, and onboarding processes to create a new technical infrastructure for you. In no time at all, you’ll enjoy the full benefits of banking chatbots.