Project highlights

- Integrate Apple Pay and Google Pay services

- Enable contactless payments via smartphones and wearables

- Ensure secure and transparent mobile payments

- Industry:

- FinTech, Digital Banking, Mobile

- Headquarters:

- Germany

- Market :

- DACH

- Cooperation:

- June 2018 – present

Business challenge

Our client is a fully digital Germany-based bank that’s a pioneer in banking solutions and applications. The first bank to introduce digital-only banking services to the DACH market, our client is one of the world’s most innovative banks, breaking new ground not only in banking but in the entire FinTech industry.

Traditional banks no longer meet the needs of today’s customers. Our client is part of the fast-evolving digital revolution and is building a bank of the future. Bringing openness and transparency to financial services, our client aims to make banking convenient, user-friendly, and accessible for end customers. In addition to next-generation banking services, our client’s offerings include crowdfunding, cryptocurrency trading, instant money transfers to social media and phone contacts, social lending, and eWallets.

Payment processing became much more convenient with the arrival of contactless mobile payment solutions. Today, customers can tap and pay using their credit cards, smartphones, and wearables.

Both Apple and Google have already introduced contactless payments via phones for their users’ comfort and for faster transactions. And given the increasing popularity of such services among consumers, banks worldwide have started to adopt the technology.

When we started working together, Apple Pay was still just on its way to Germany. Our client wanted to become one of the first adopters of this technology. Known as a disrupter in the banking market in the DACH region, the company decided to accelerate the digital transformation of the banking industry and meet their clients’ needs with contactless mobile payments.

Integrating Apple Pay and Google Pay, which have been rolling out globally at a rapid pace, is an emerging challenge for banks and retailers due to the strict implementation demands and security and regulatory requirements. Our client asked for our expert help to integrate Apple Pay and Google Pay.

Both Google Pay and Apple Pay come with a set of standard requirements that financial institutions must meet if they wish to offer these mobile payment services. These standards allow Google and Apple to make sure their services work flawlessly no matter the provider.

Based on previous successful cooperation with Intellias, our client turned decided to establish a partnership with us again to smoothly implement contactless payment services.

Technology solution

Together with our client’s team, Intellias experts focused on improving the backend of the entire Apple Pay and Google Pay integration.

Consumers can use Apple Pay and Google Pay by registering a credit or debit card in a mobile wallet or a customized banking app. These wallet apps require third-party SDK providers, digital directories, or payment processors and card issuers like uPaid and petaFuel to activate Apple Pay and Google Pay services. Intellias, a reliable technology and consulting company, helps businesses implement multiple payment services into a single app.

We integrated Apple Pay as follows:

Apple required our client to implement specific functionality in order to offer Apple Pay services. We helped our client do that.

Intellias experts enabled two activation options — via a wallet app and via the client’s banking app (in-app provisioning). To initiate Apple Pay integration, we aligned the banking app’s functionality with Apple’s requirements, which are divided into 11 primary categories:

- Provisioning

- User authentication (ID&V)

- Issuer mobile app

- Fraud prevention

- Apple Pay transaction processing

- Card art/metadata

- Push notifications

- Card lifecycle management (CLM)

- Issuer loyalty systems

- Provisioning notifications

- Service notifications

Together with third-party card issuer petaFuel, we set up Apple Pay for our client before the official launch of the service in Germany.

We integrated Google Pay as follows:

Unlike Apple Pay, implementing Google Pay required a third-party SDK provider. To integrate the payment service into our client’s existing banking application, we partnered with payment processor uPaid.

Intellias specialists paid much attention to security, making eCommerce transactions as safe as EMV chip transactions. We also prepared ten single-use keys (SUKs) for each of our client’s end customers to use Google Pay services even when offline. As soon as a device comes back online, the SUKs are renewed automatically.

The entire development process was divided into three phases:

The first phase was developing the registration process, which involved:

- customer registration

- device binding

- checking device SDK eligibility

- implementing positive and negative eligibility check scenarios

- mobile PIN setup and wallet activation

- digitization and tokenization processes provided by the uPaid SDK

- petaFuel sending credit card credentials to uPaid

The second phase was developing the payment process:

- One-tap scenario: Payment is initiated by the customer launching an application manually. The customer picks a card, enters their PIN, and chooses Pay now, which starts the payment process. Then the application is ready to exchange data with a terminal. If the user locks the phone, drops the application to the background, or hits cancel, the process is interrupted.

- Two-tap scenario: Payment is initiated by tapping the device to a terminal. Then the user provides a PIN on the device, after which a secondary tap is needed. Like in the one-tap scenario, the process can be canceled by locking the device or dropping the payment application to the background, or if the operation times outs.

The third phase was implementing the card lifecycle:

- Suspend: A card can be temporarily suspended from posting transactions. This is communicated with Mastercard digital enablement services (MDES) and blocks the possibility to complete any transactions.

- Unsuspend: Activates a temporarily suspended card. As a result, the card is no longer suspended, and the wallet application can start processing transactions and collecting SUKs for this card.

- Delete: A card can be deleted from the app. Keep in mind that the permanent account number (PAN) isn’t what’s deleted from the wallet database. Instead, what’s deleted is the virtual card number — the result of digitization. This process can’t be undone, but customers can digitize their cards once again to re-add them.

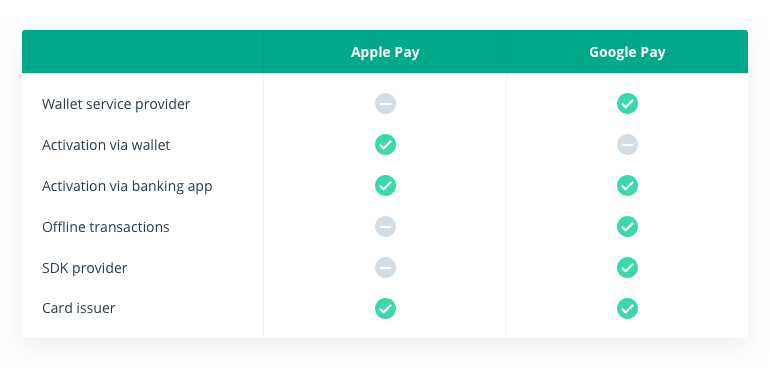

Main implementation differences between Apple Pay and Google Pay

Business impact

Aiming at open and innovative digital banking, our client wanted to integrate Apple Pay and Google Pay — services that are transforming digital payments by offering a secure and convenient way to pay.

With the help of Intellias, our client managed to become one of the first banks to roll out Apple Pay and Google Pay services in Germany. Contactless mobile payments are now available to all of the bank’s retail and business customers with Mastercard. We helped our client continue growing and enhance the customer experience.

The solution we’re developing brings these advantages to our client:

- Increased customer satisfaction

Demand for mobile payments is on the rise. The launch of Apple Pay and Google Pay services allows our client to target digital-savvy customers. By providing easy and highly secure payments, our client has increased their customer satisfaction score.

- Competitive edge

As not all banks and financial institutions let their customers use mobile payments, our client has a competitive edge.